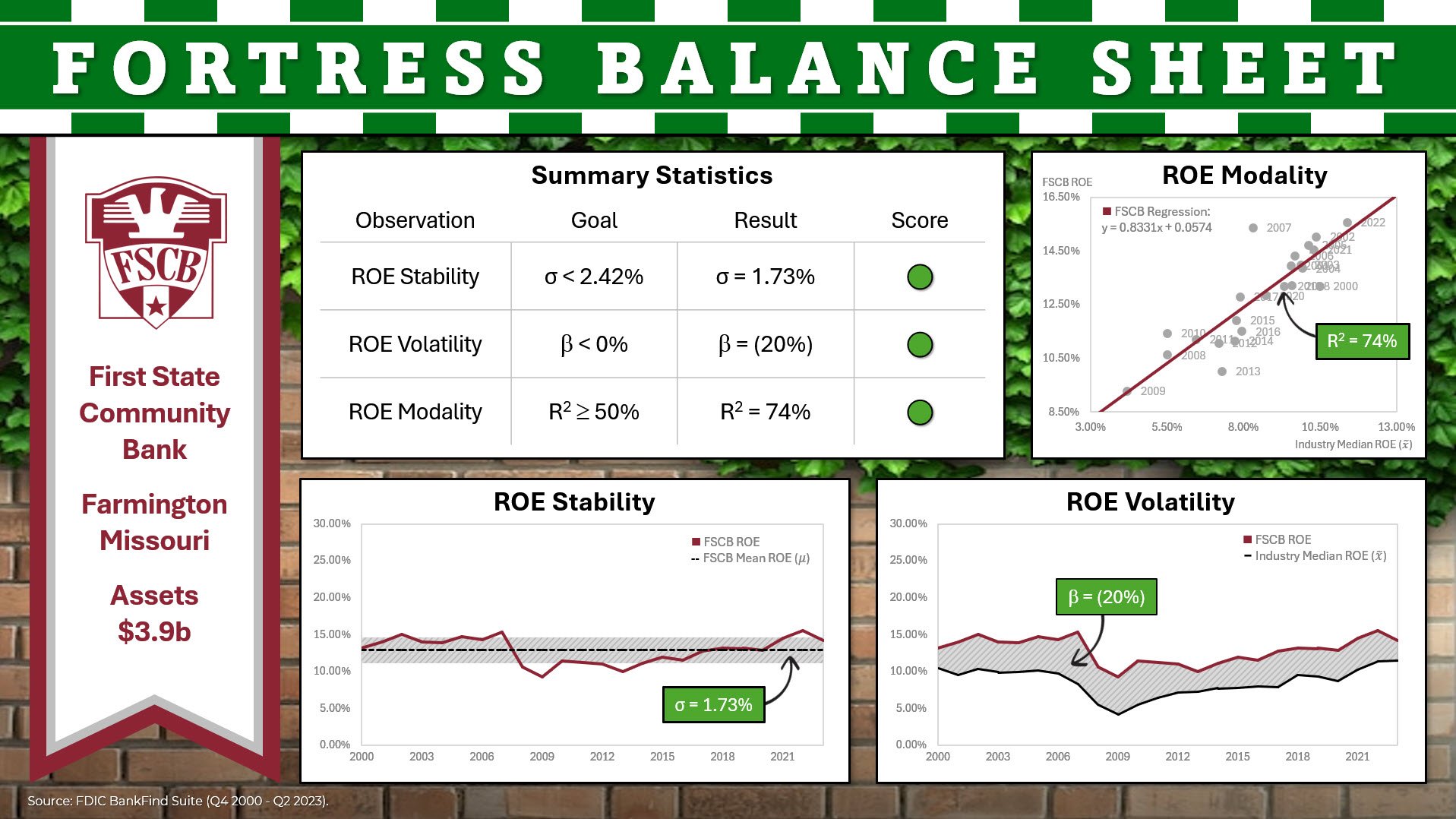

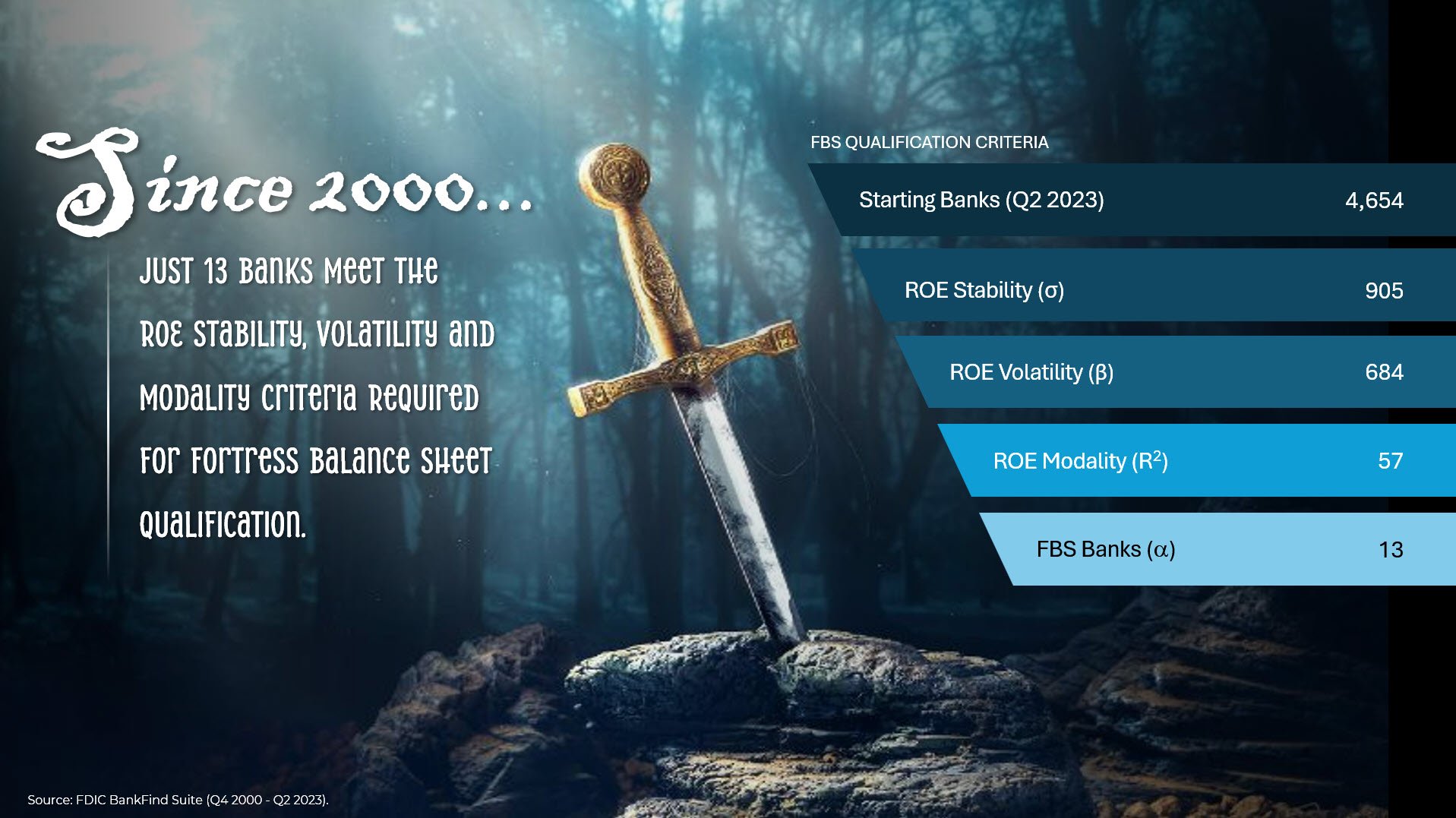

Jamie’s Fortress Blueprint

Highlighting the competitive advantage of a fortress balance sheet.

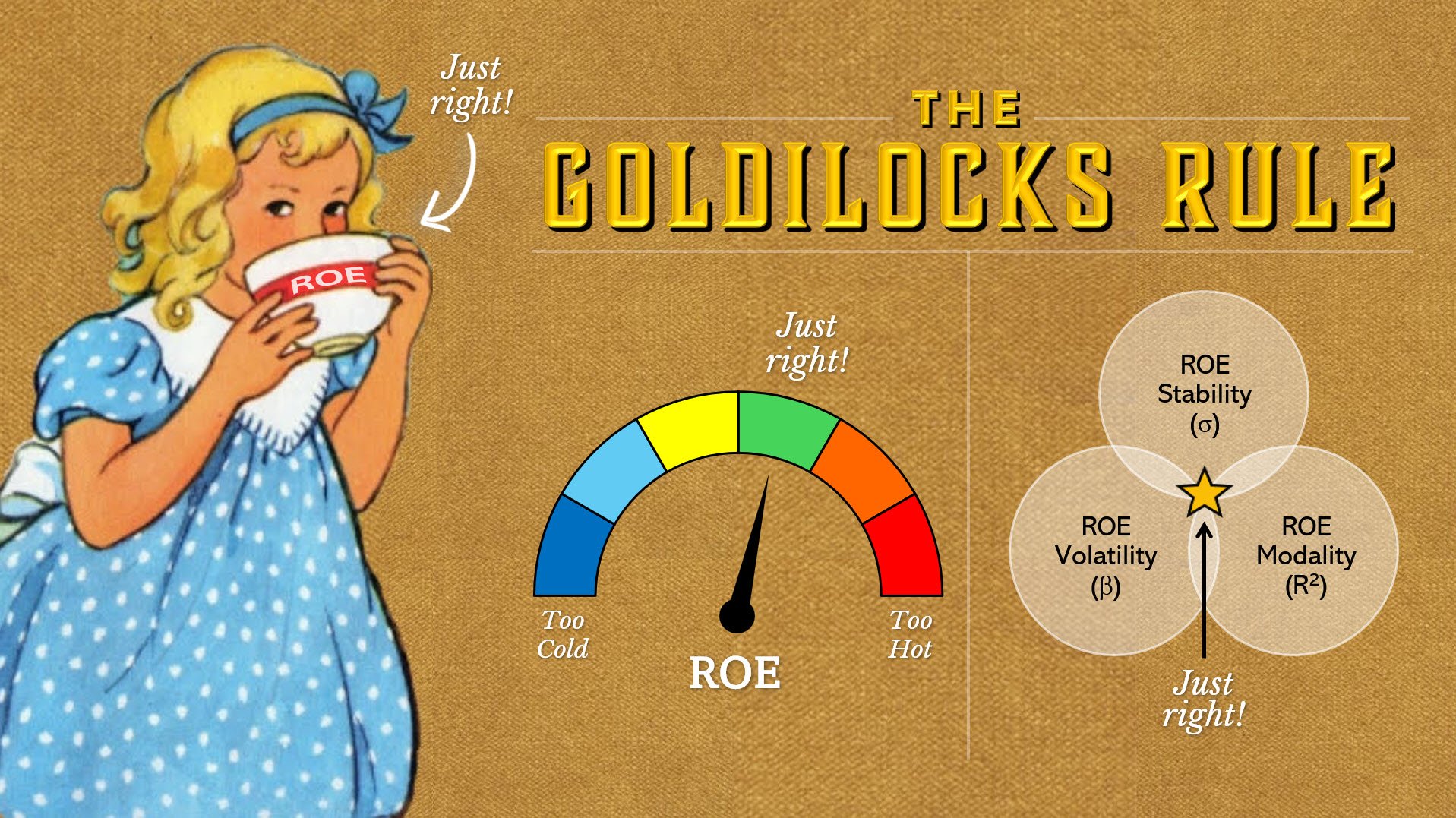

The Goldilocks Rule

Goldilocks banks produce ROE that is “just right” – never running too hot or too cold.

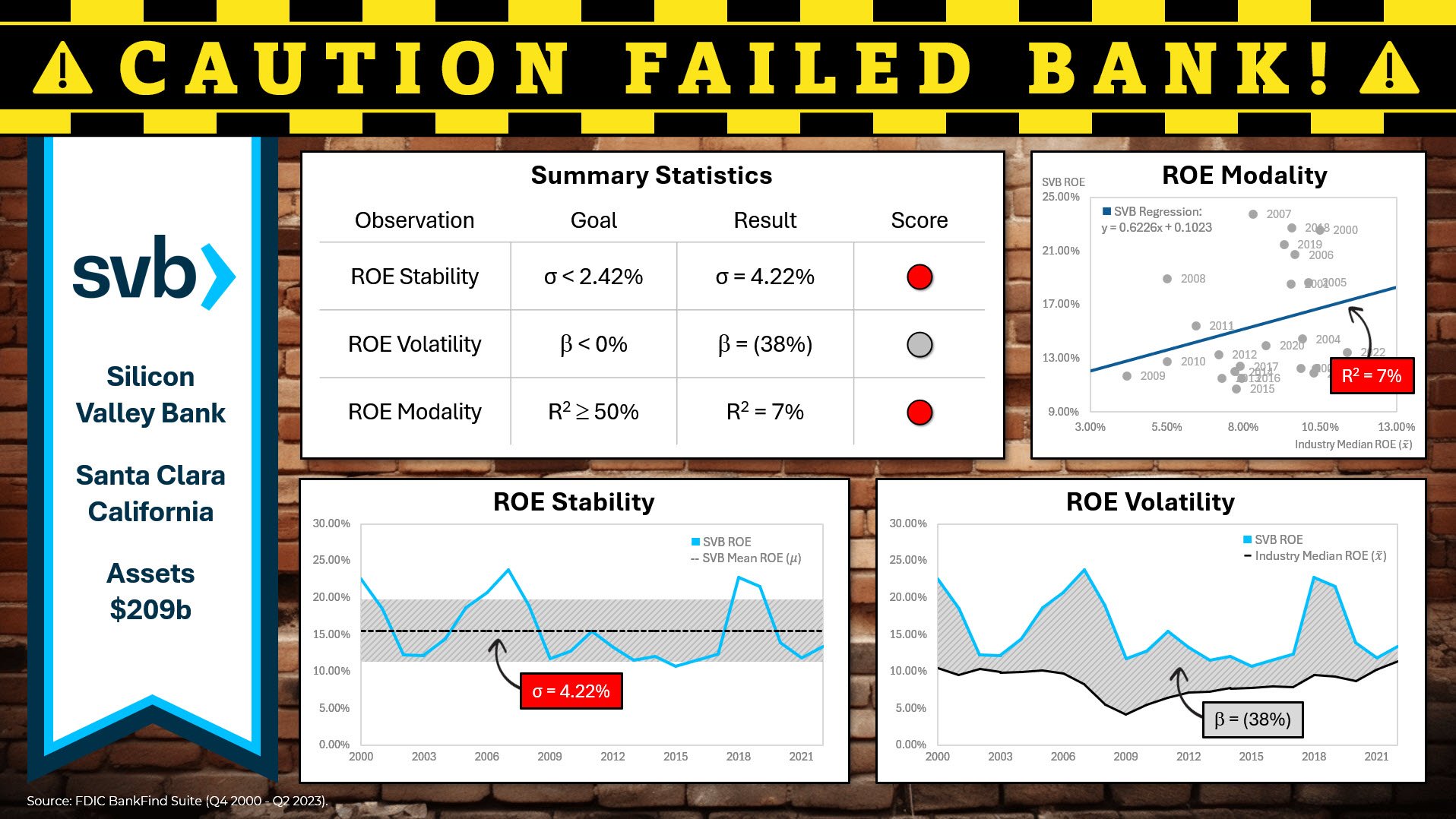

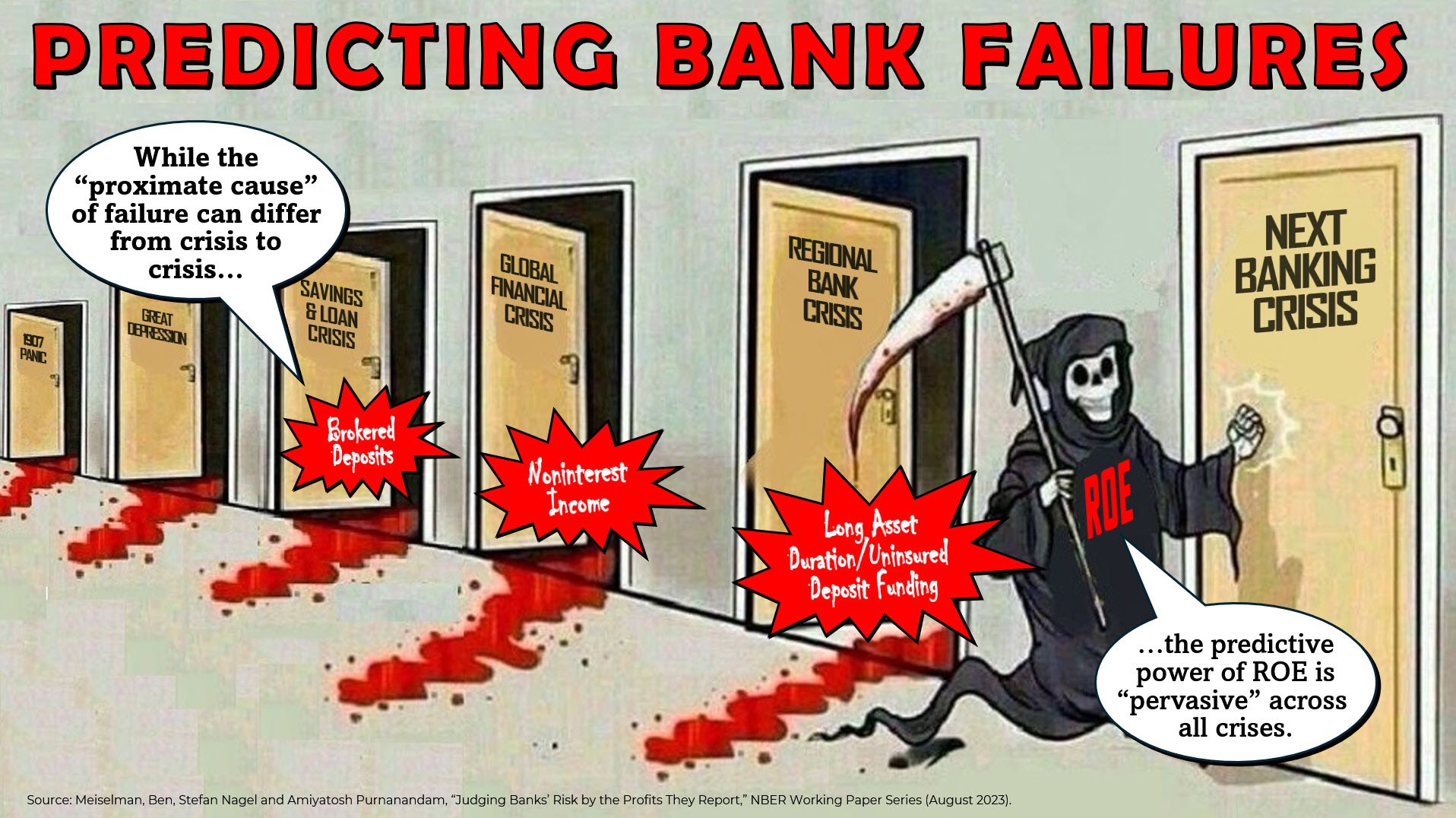

Predicting Failure

The power of ROE to predict a bank’s ability to withstand a crisis is “pervasive”.

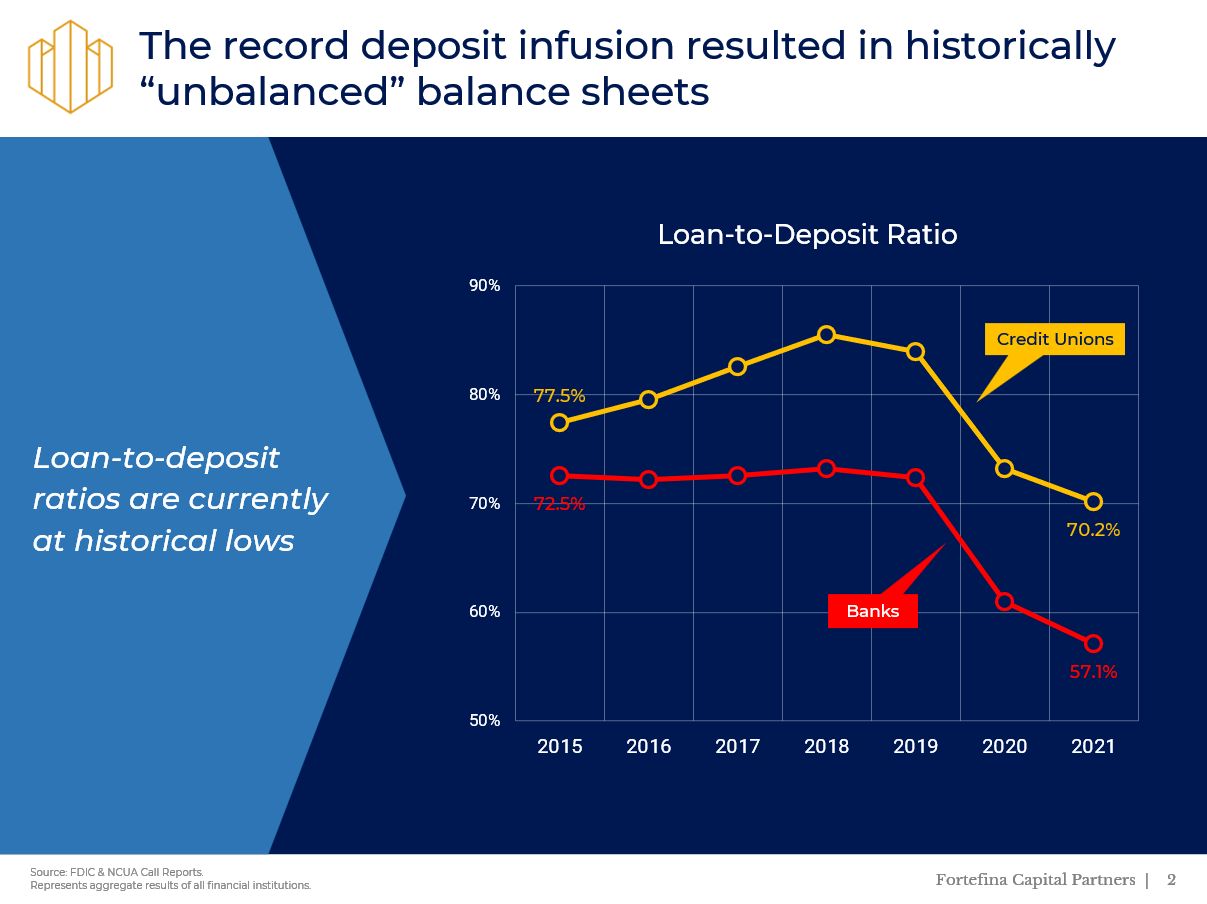

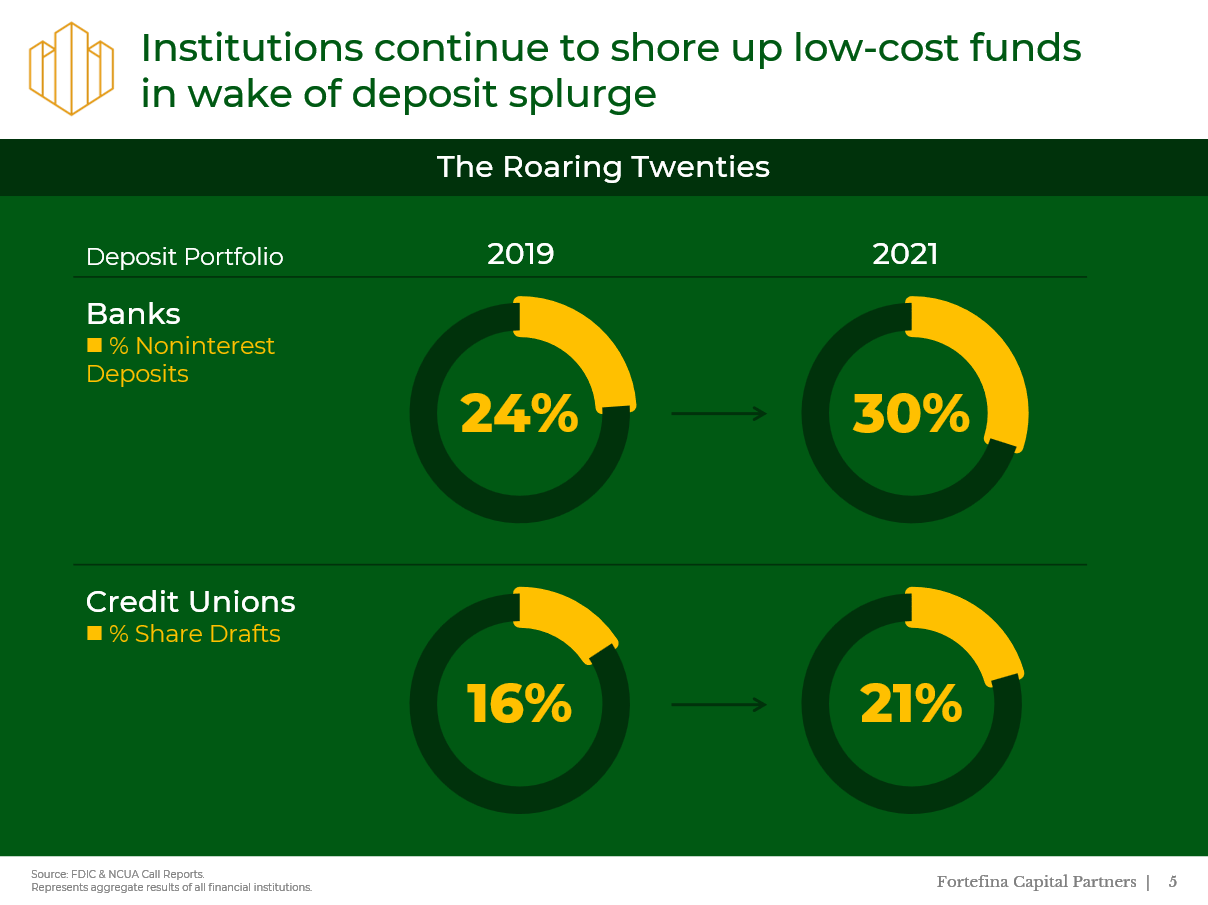

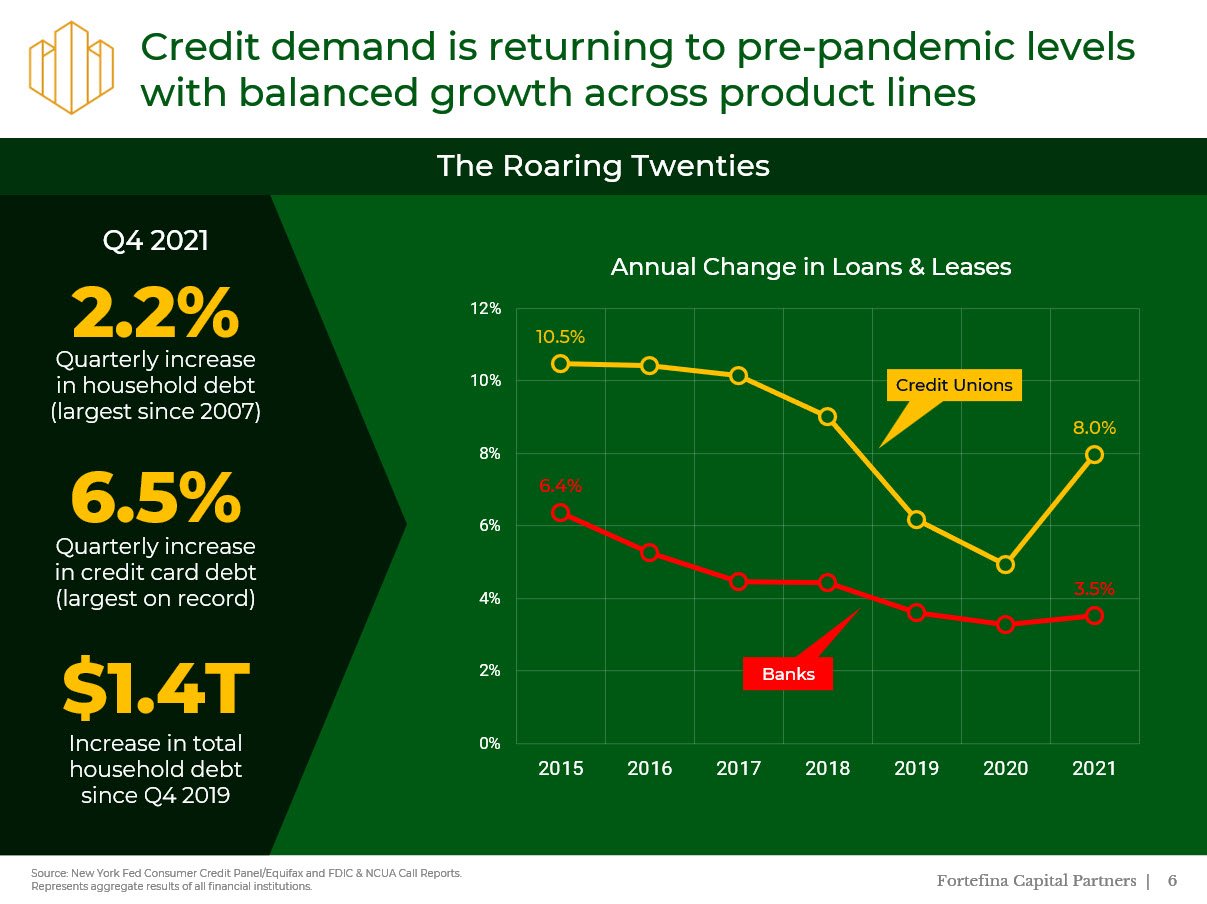

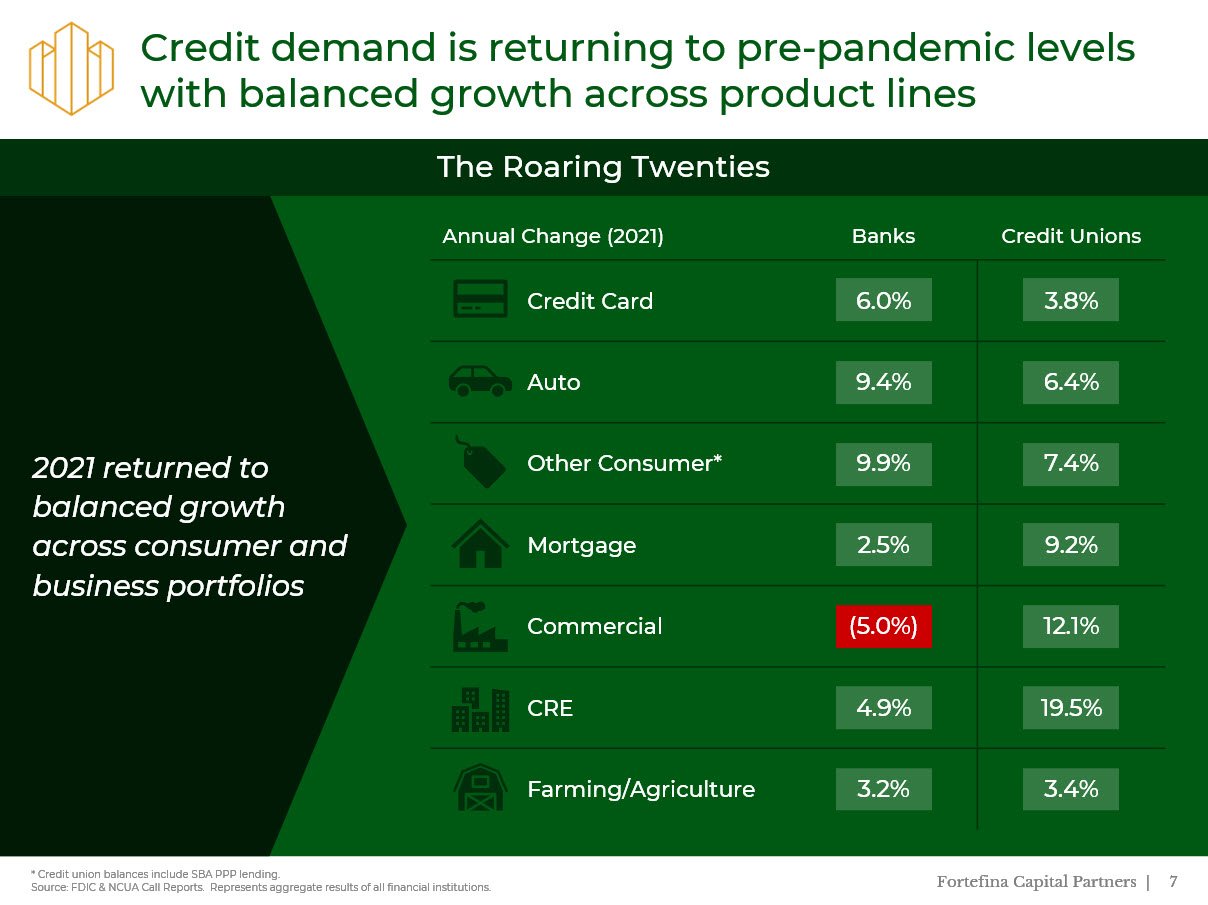

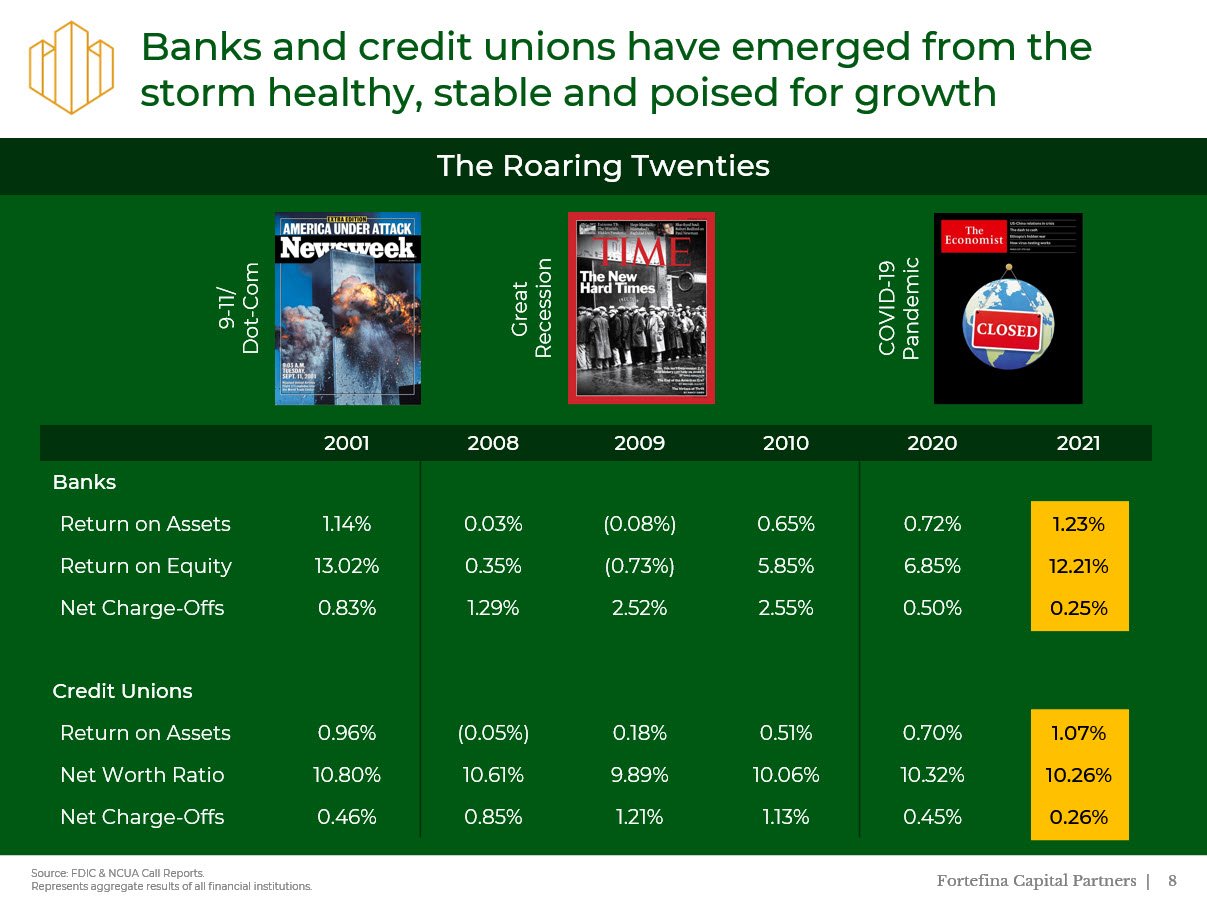

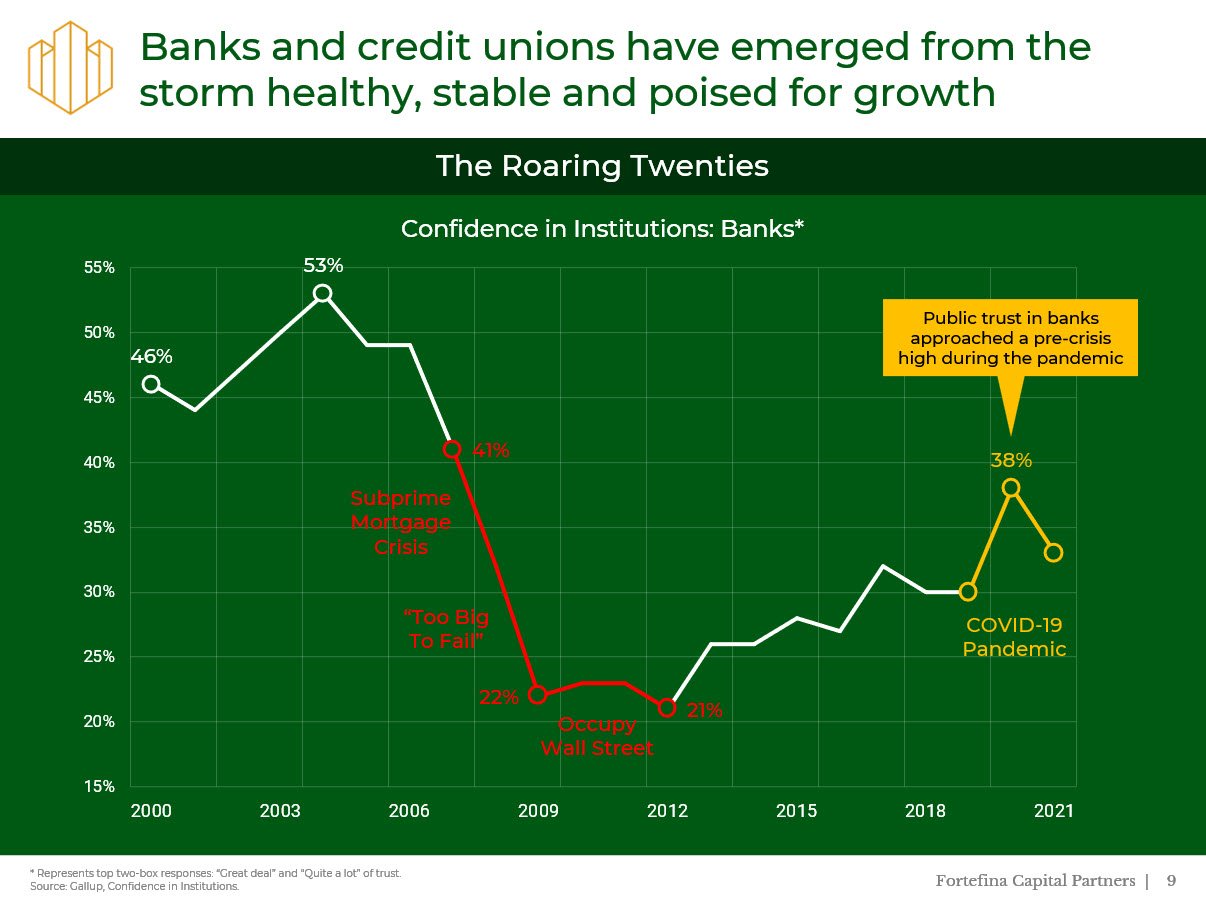

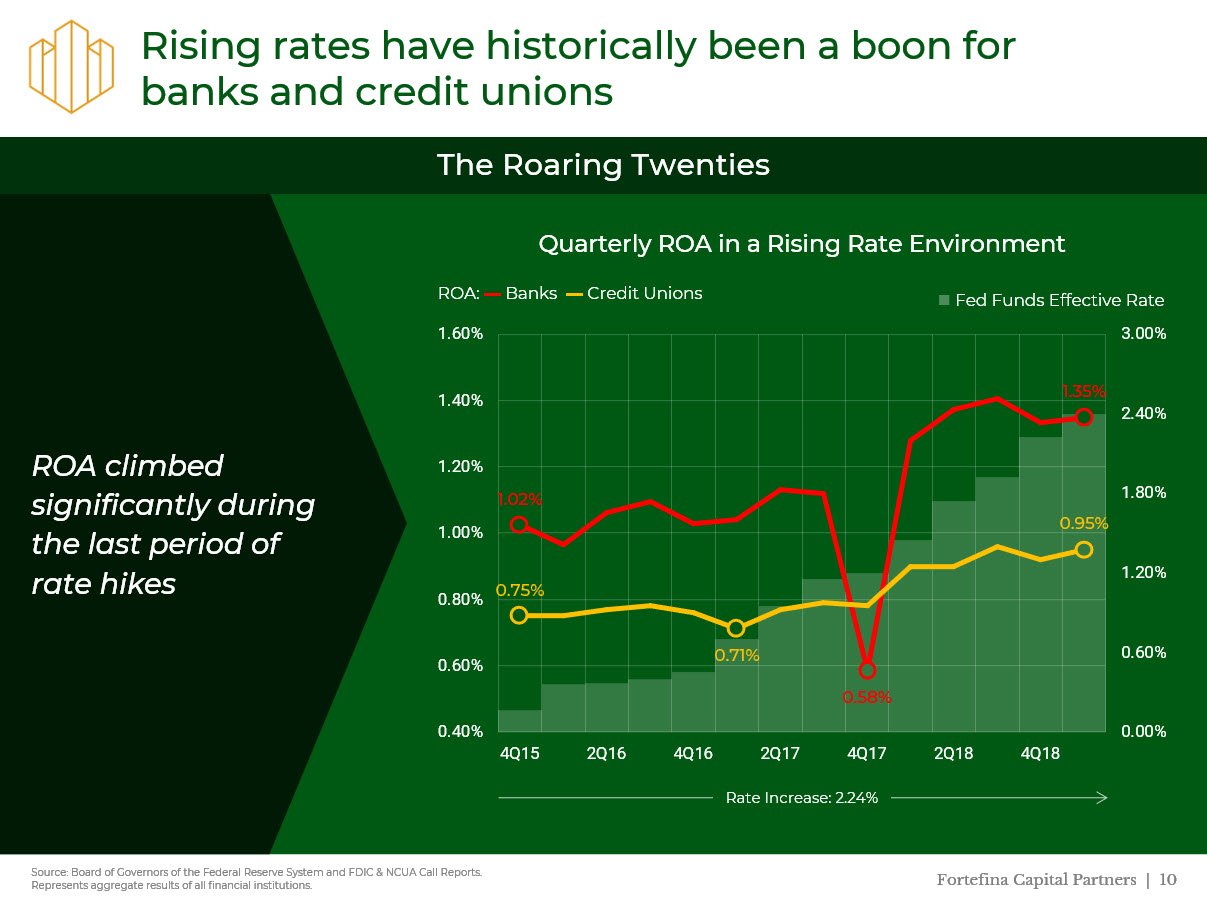

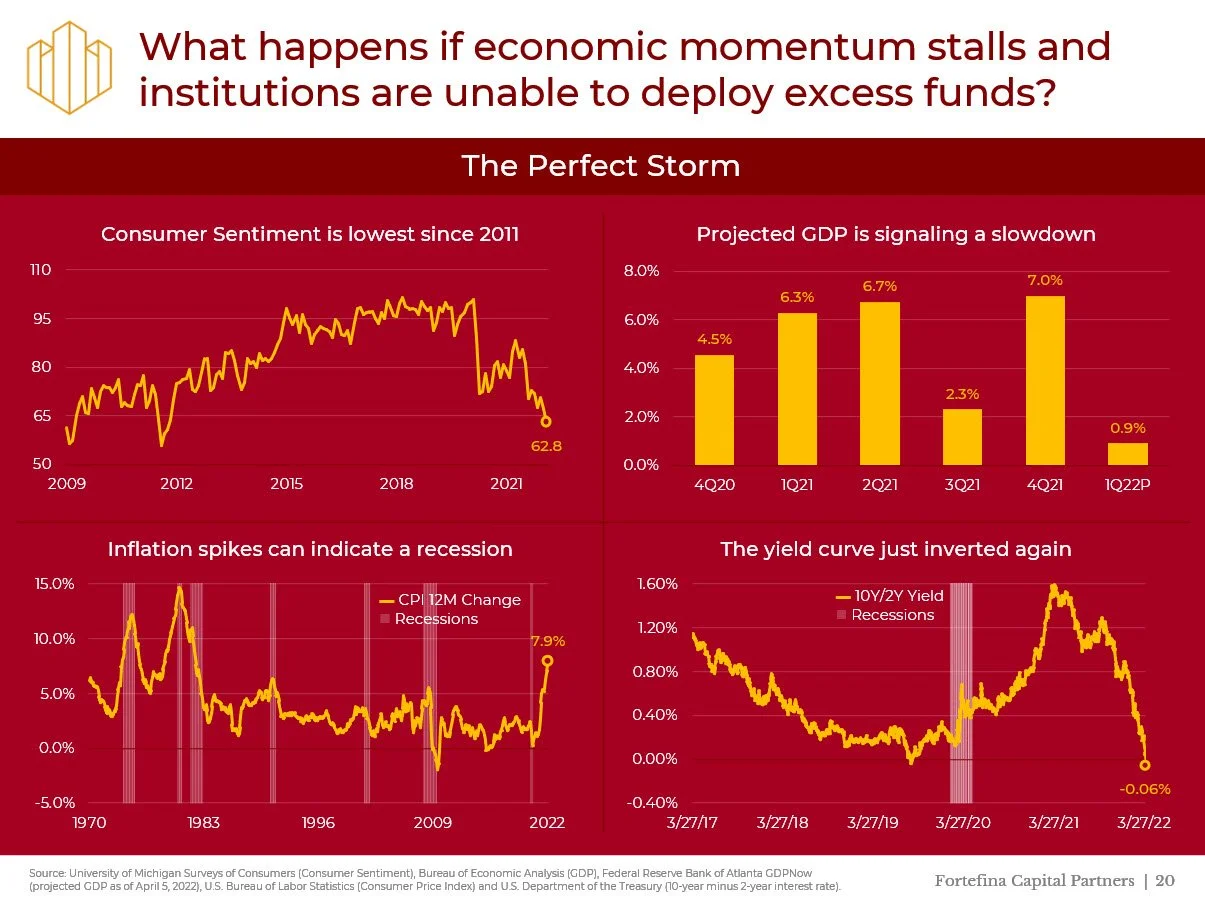

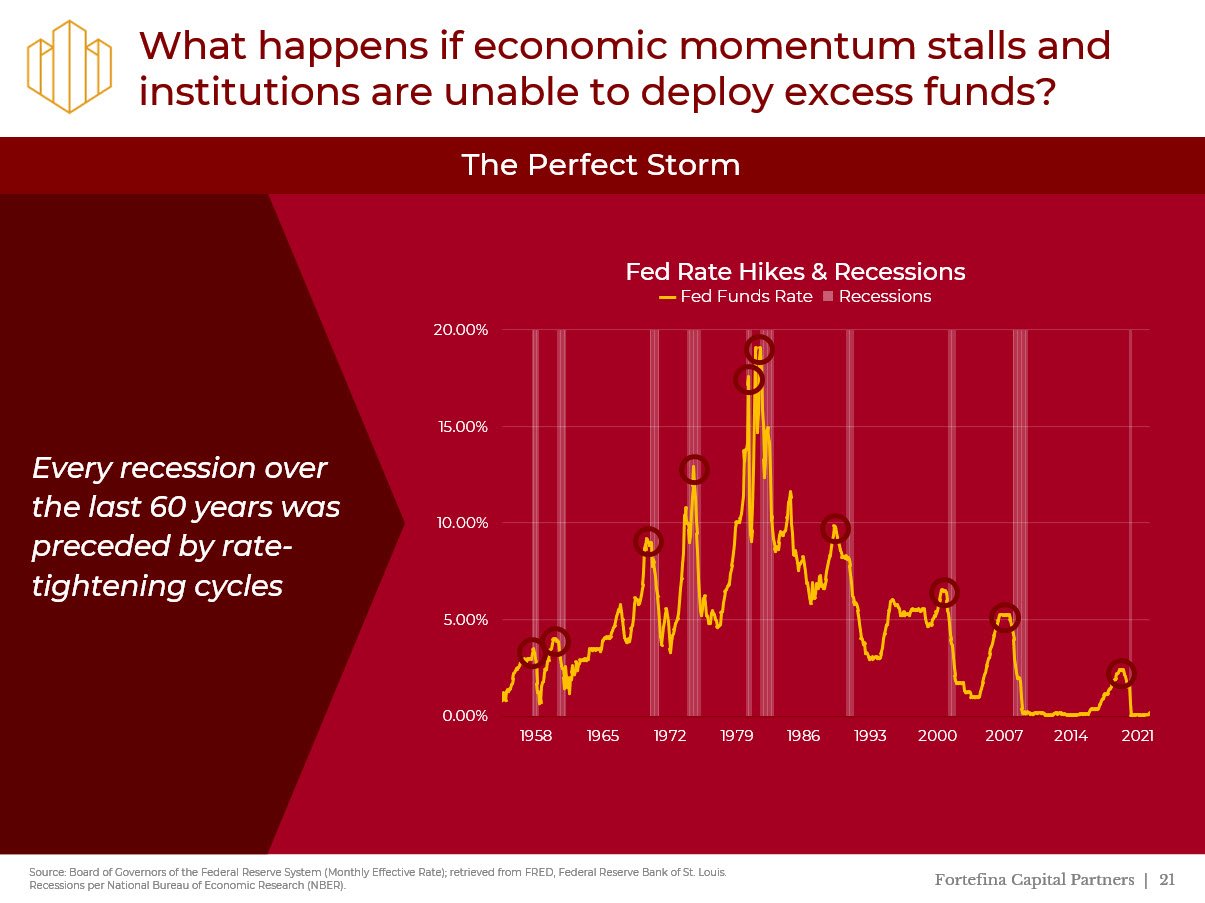

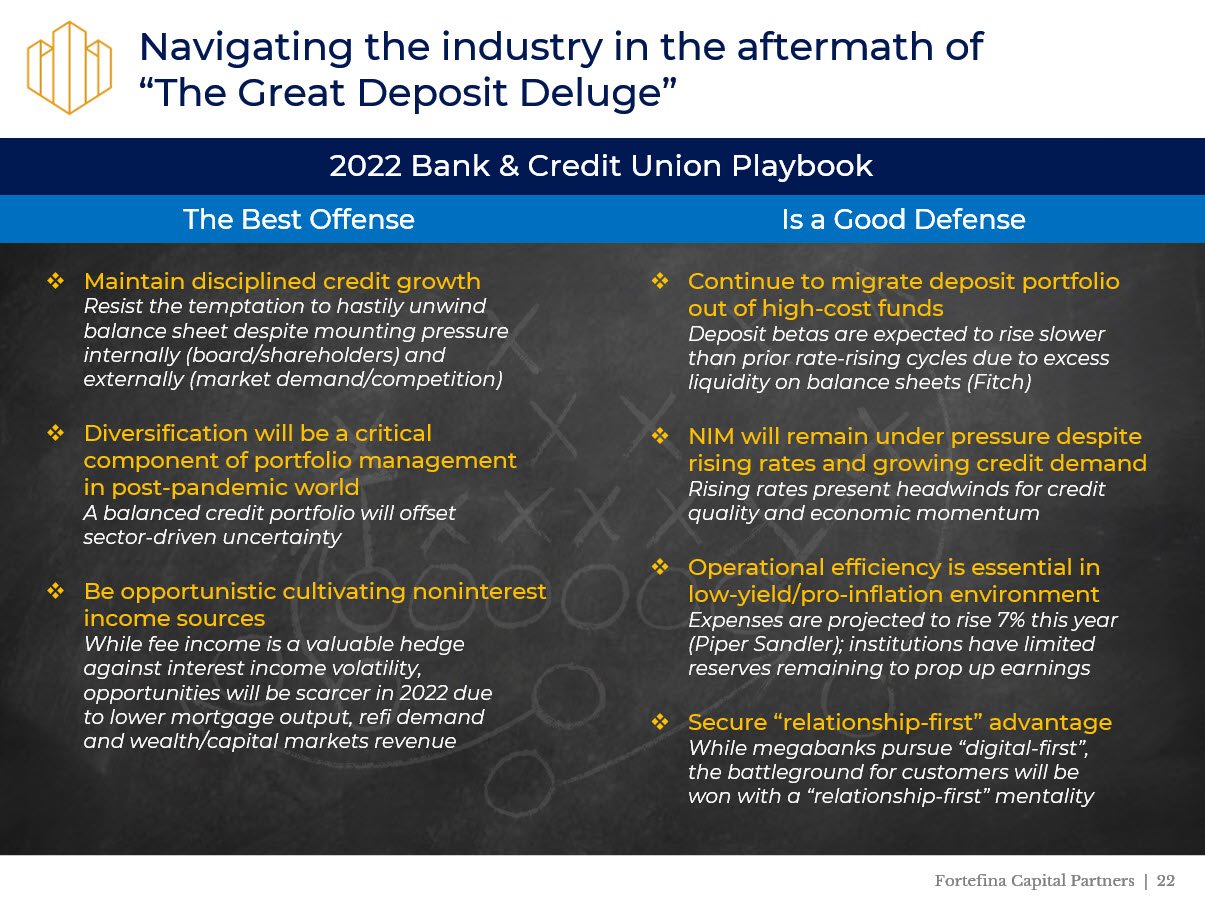

The Great Deposit Deluge

Presenting the 2022 industry review for Fortefina’s bank and credit union clients.

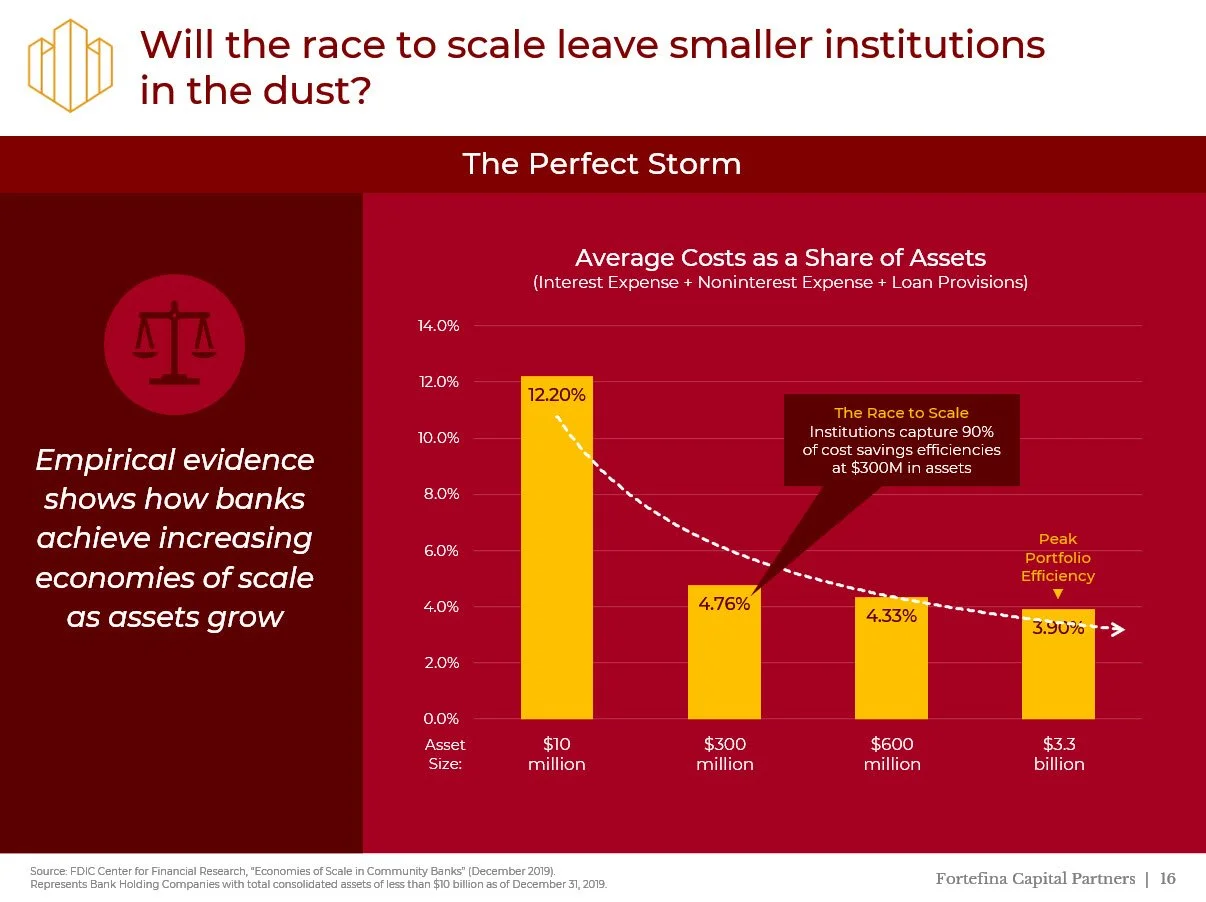

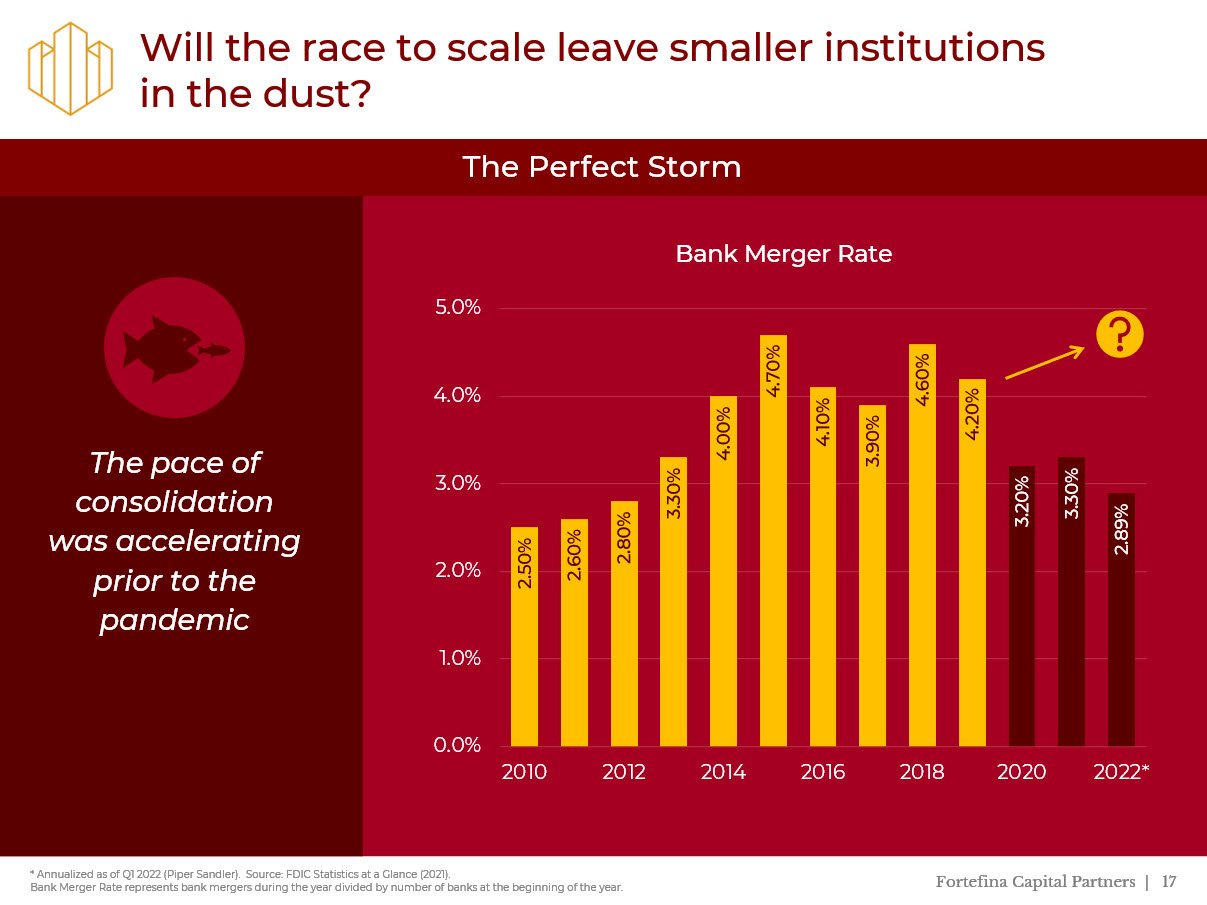

Gaining Scale

Banks can achieve increasing economies of scale by growing their loan portfolios.

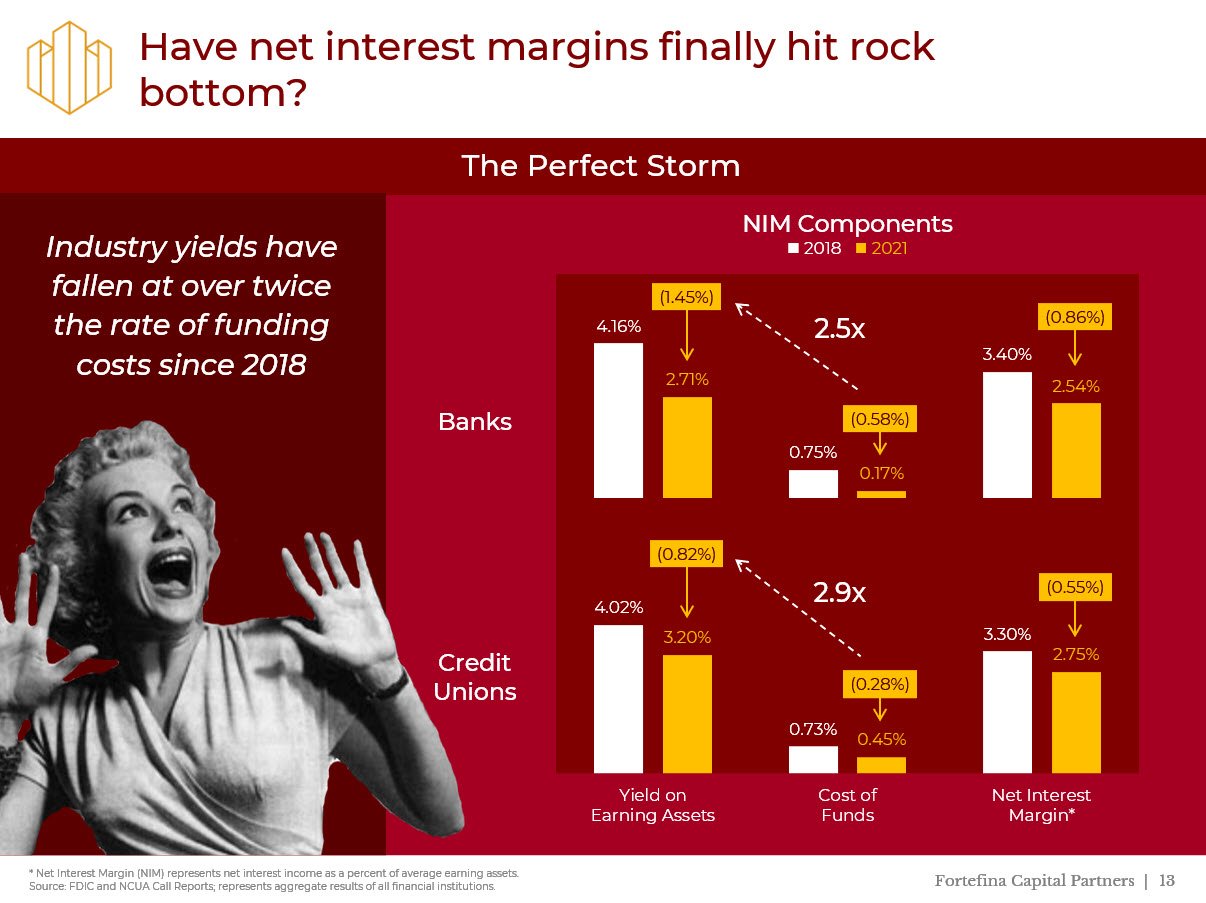

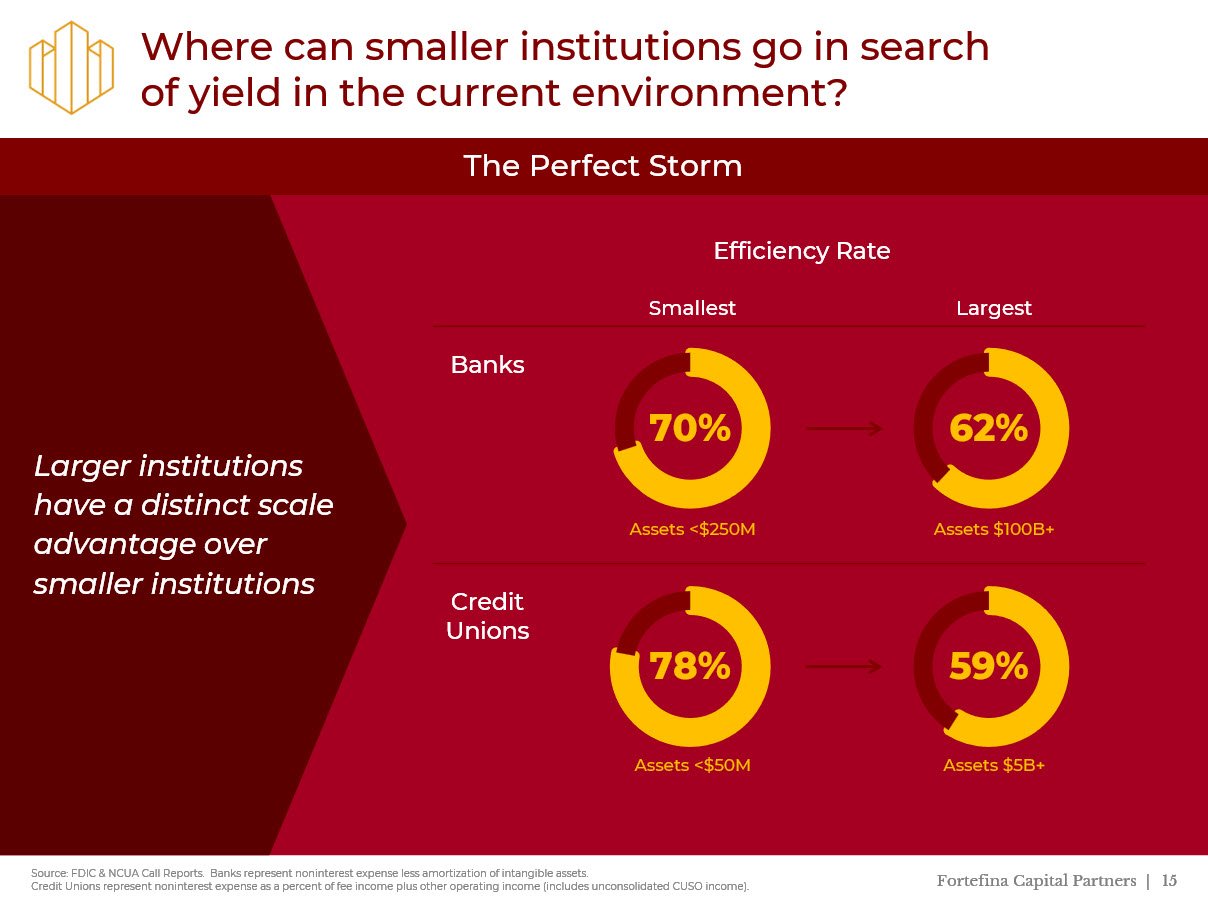

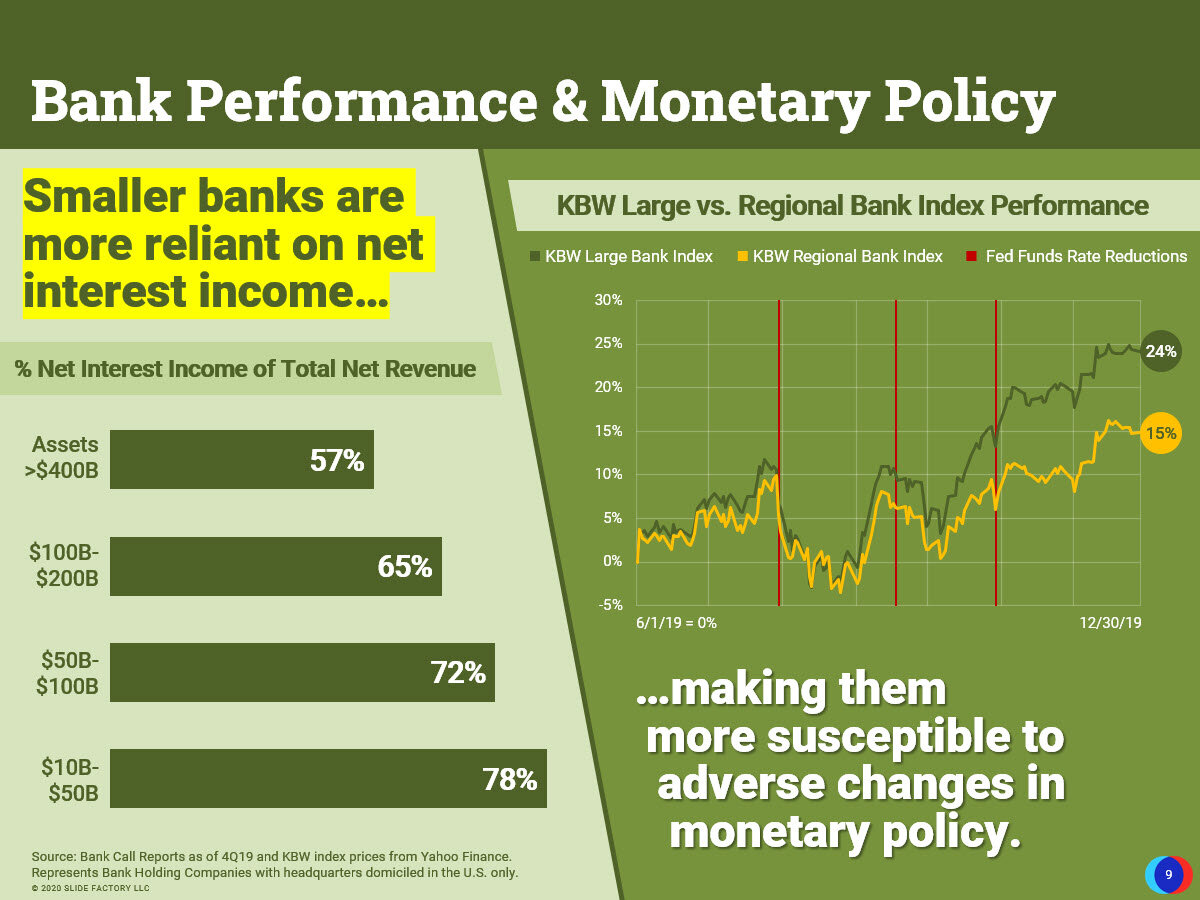

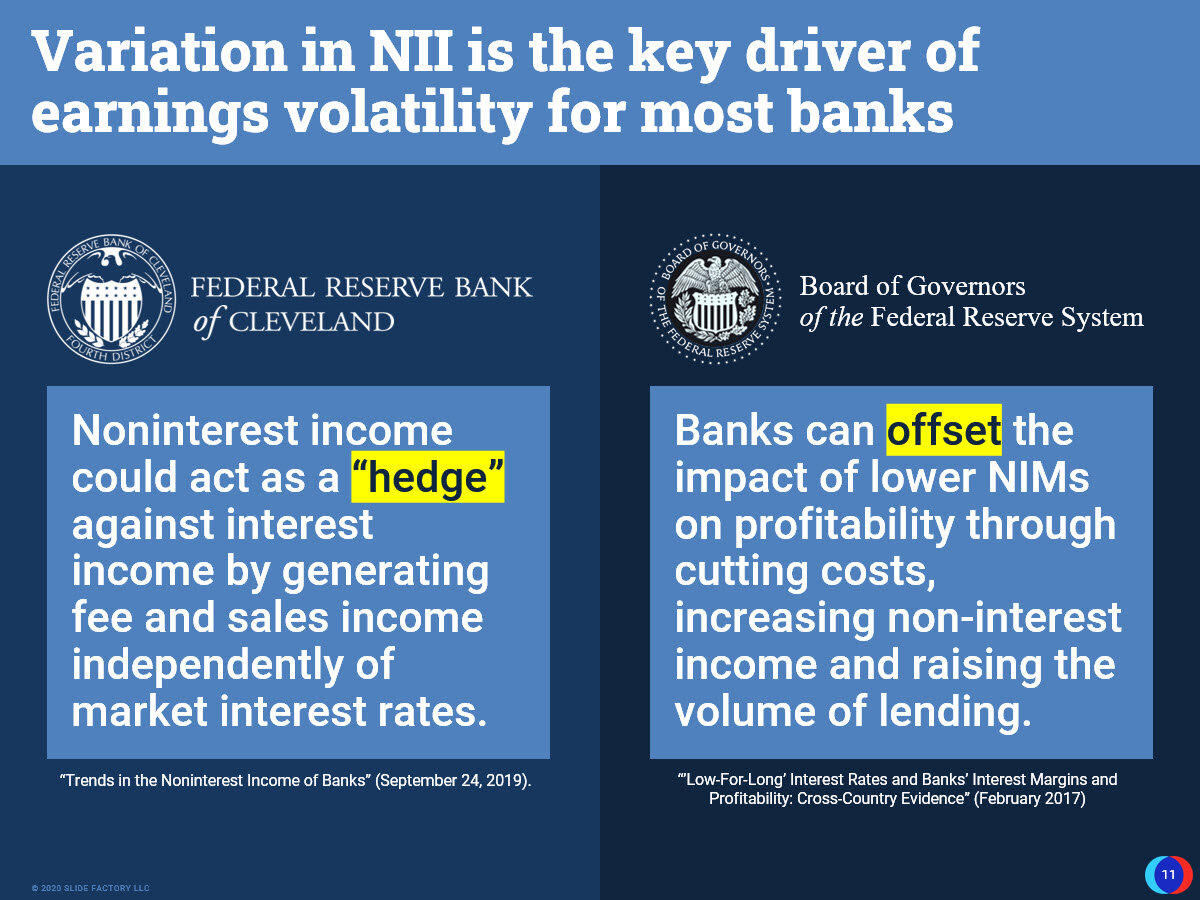

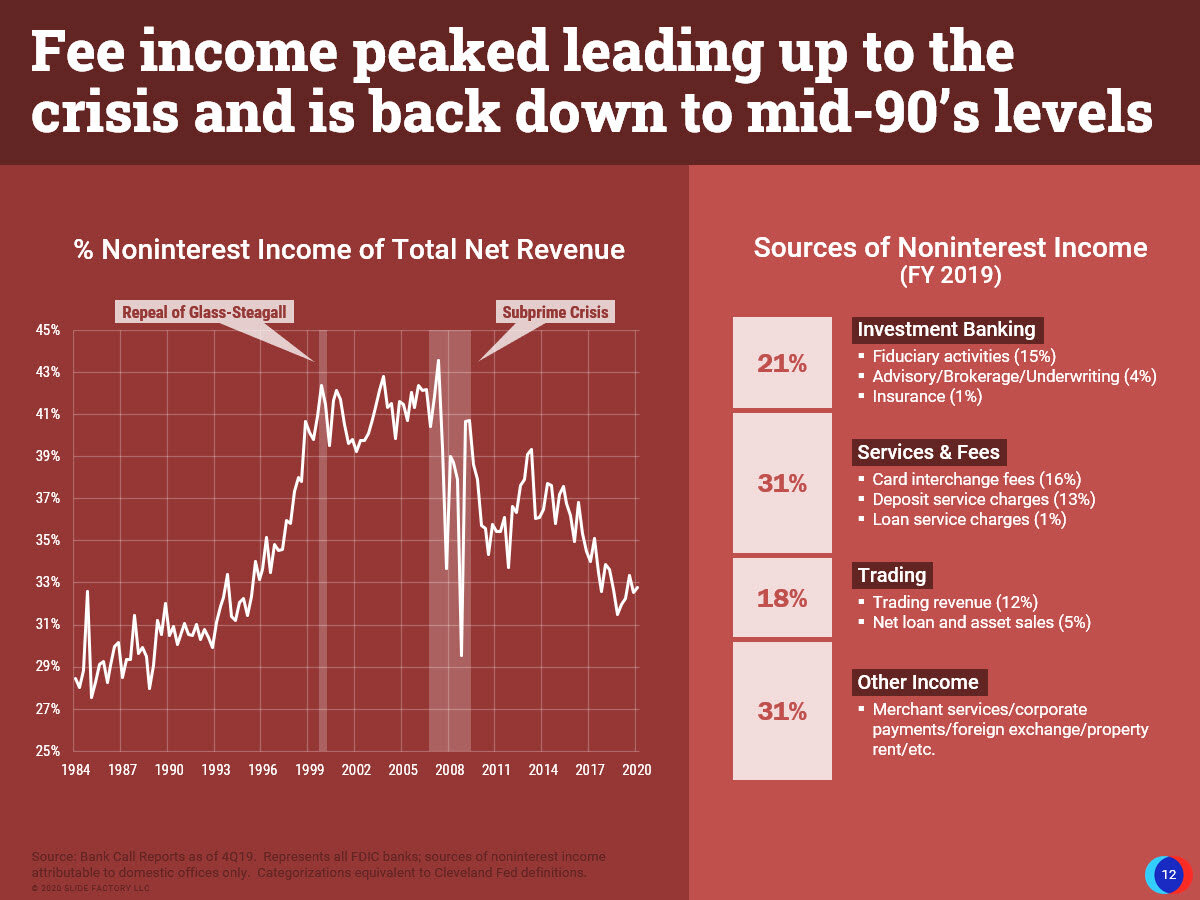

Searching for Yield

With Q3 NIM dropping to a record low, banks will need to go in search of new frontiers for yield — namely via acquisition, securities investments, noninterest income and greater overhead efficiency.

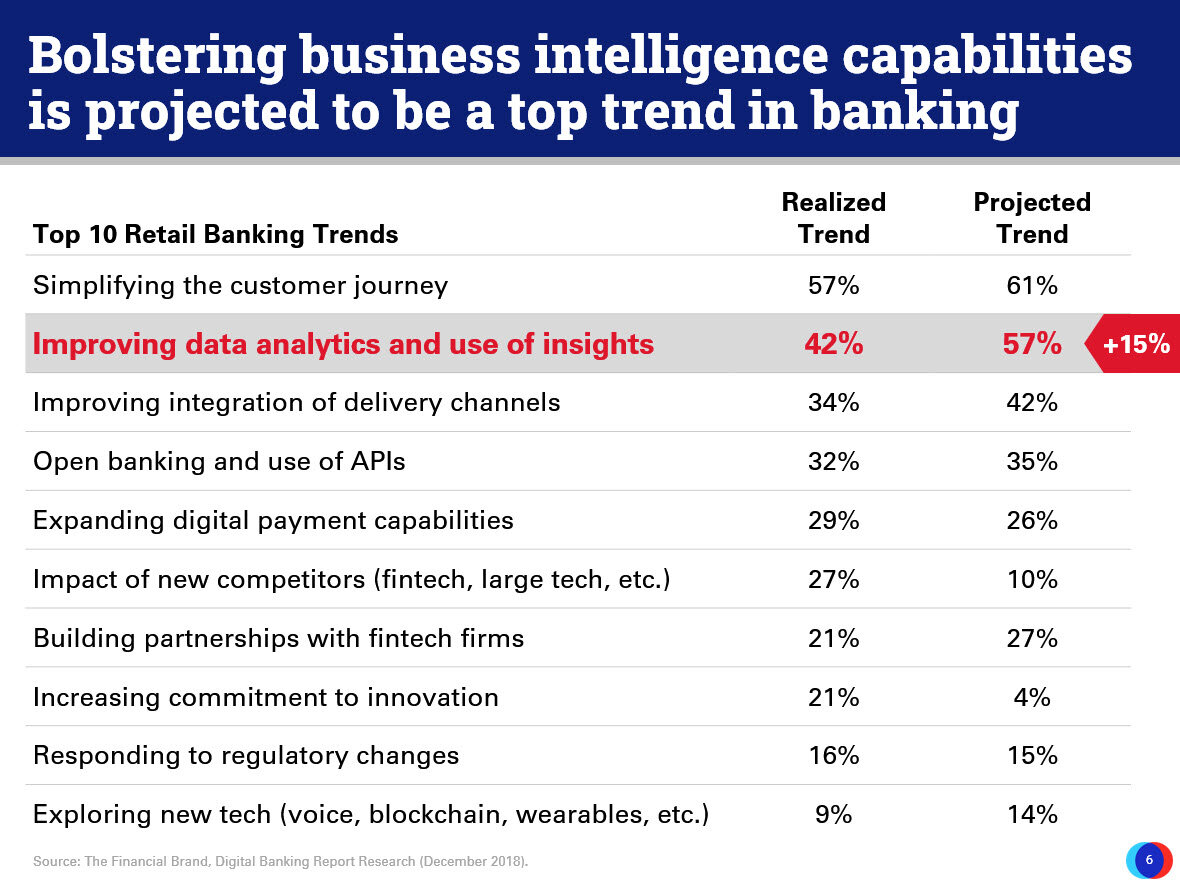

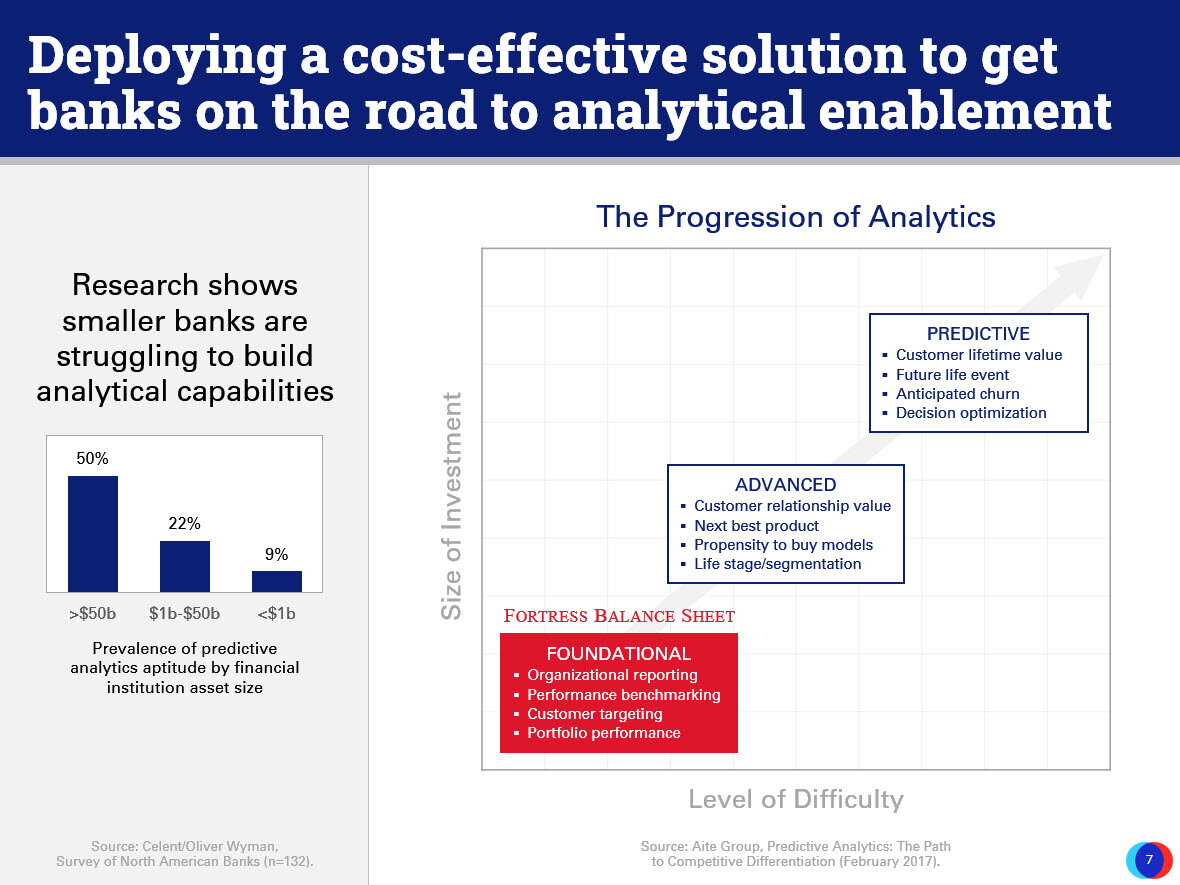

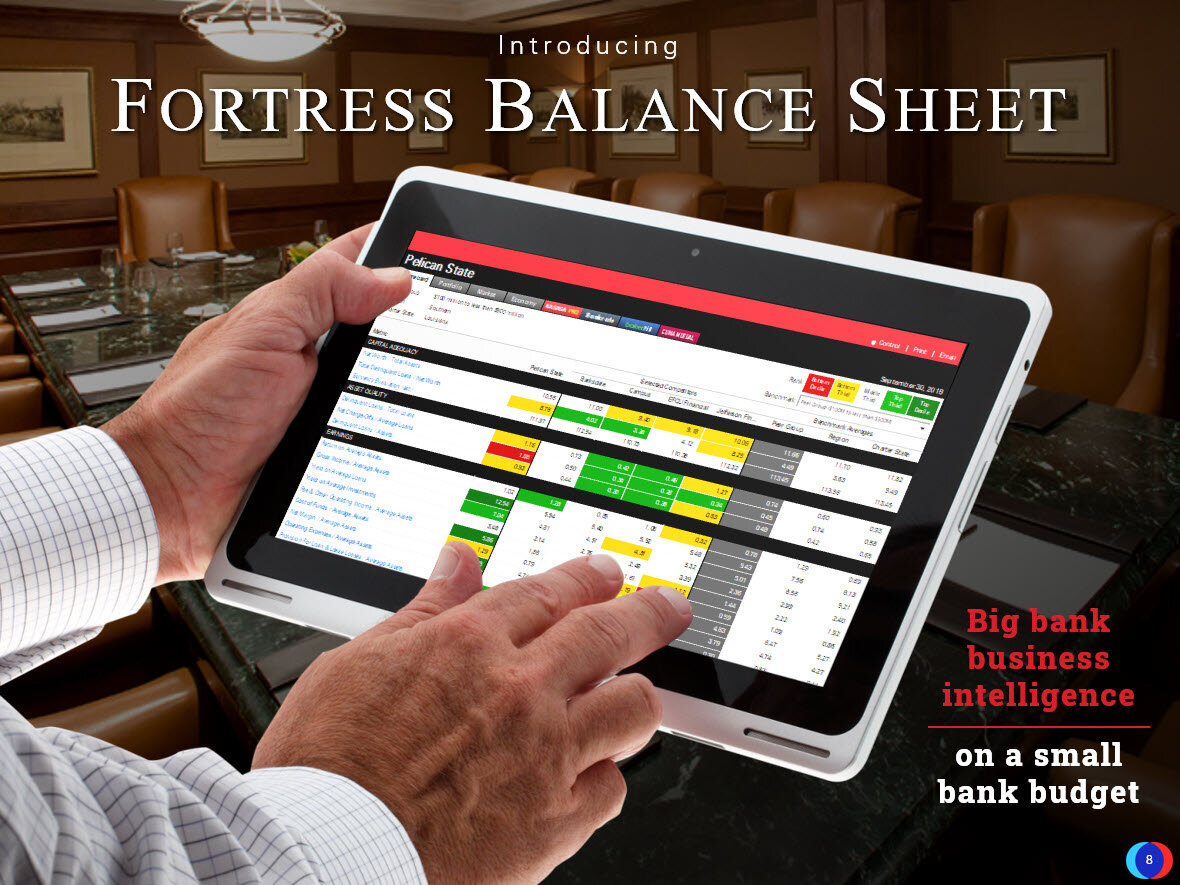

Bank Business Intelligence

Looking for big bank business intelligence on a small bank budget? Visit www.fortressbalancesheet.com to learn more!

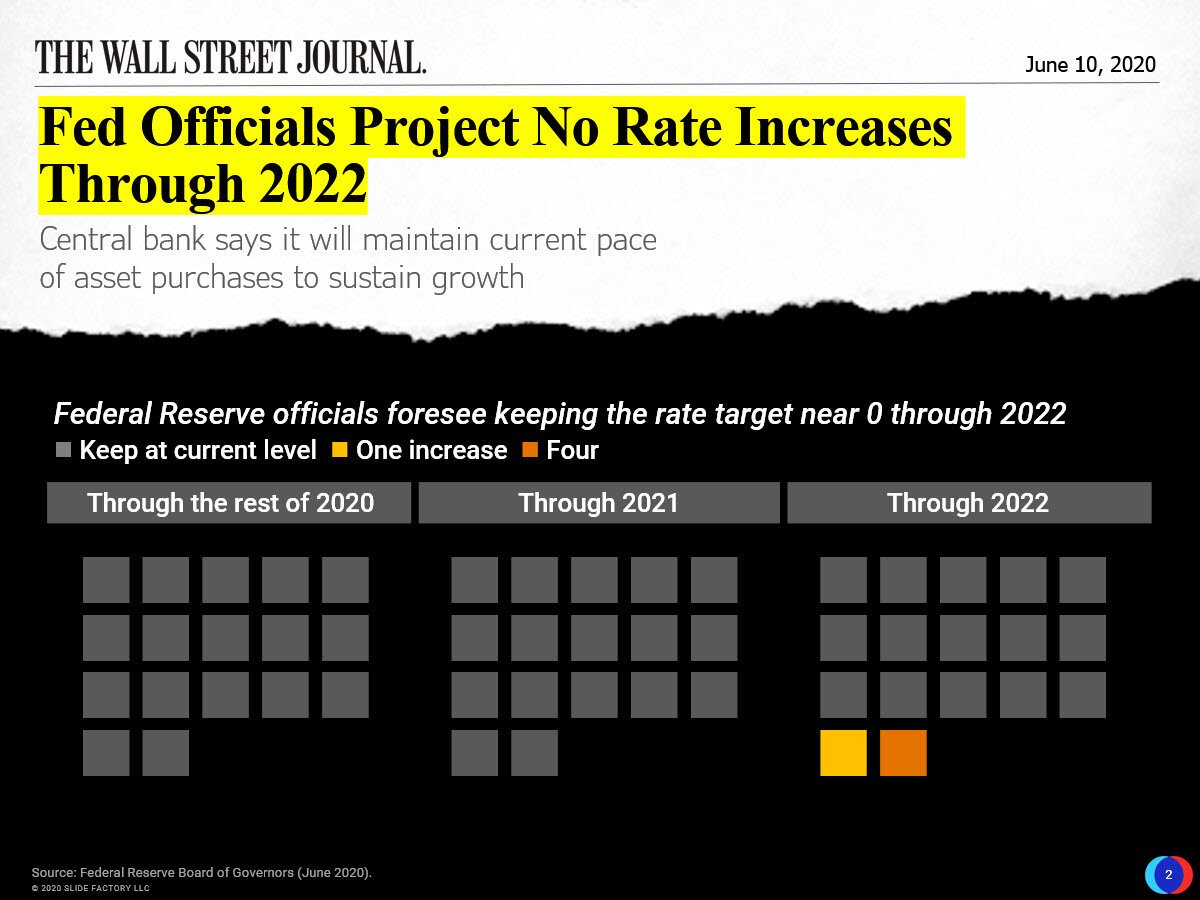

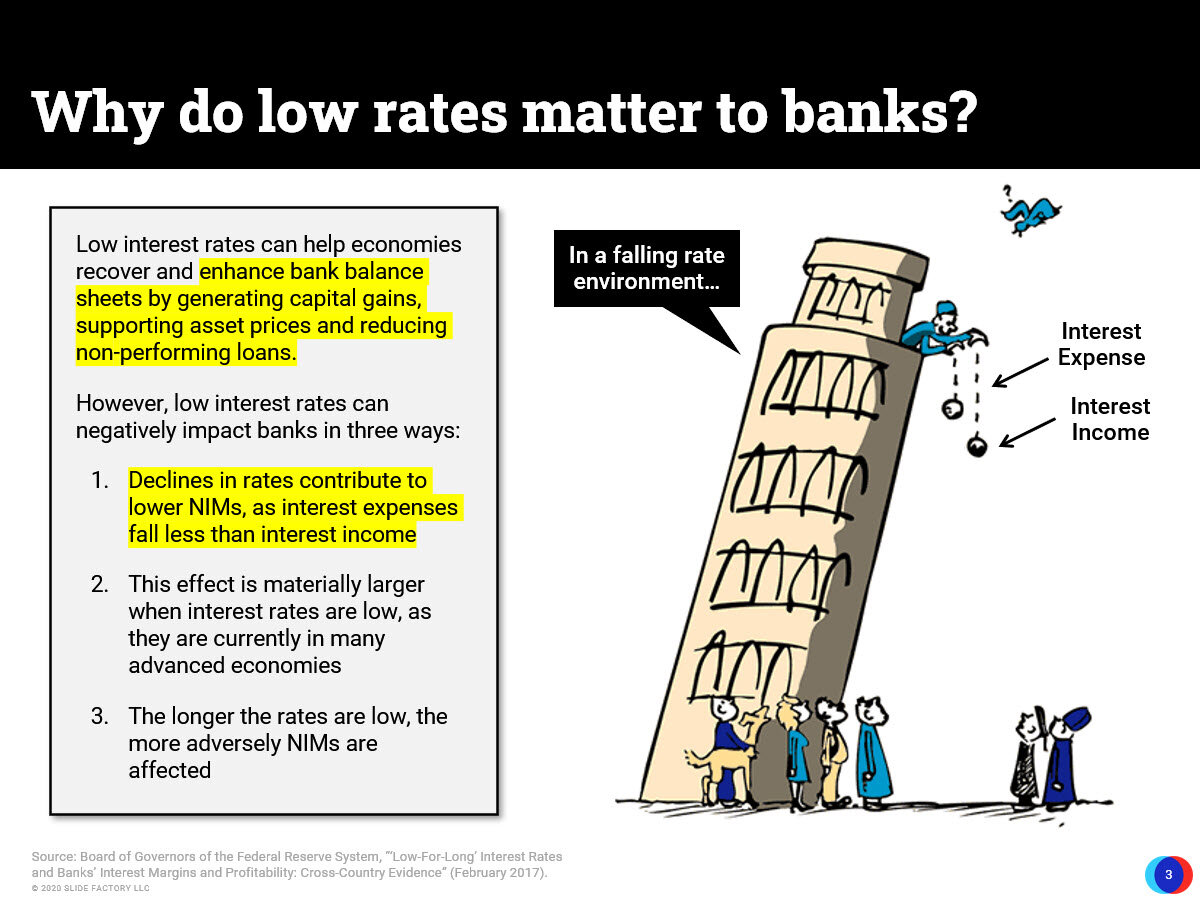

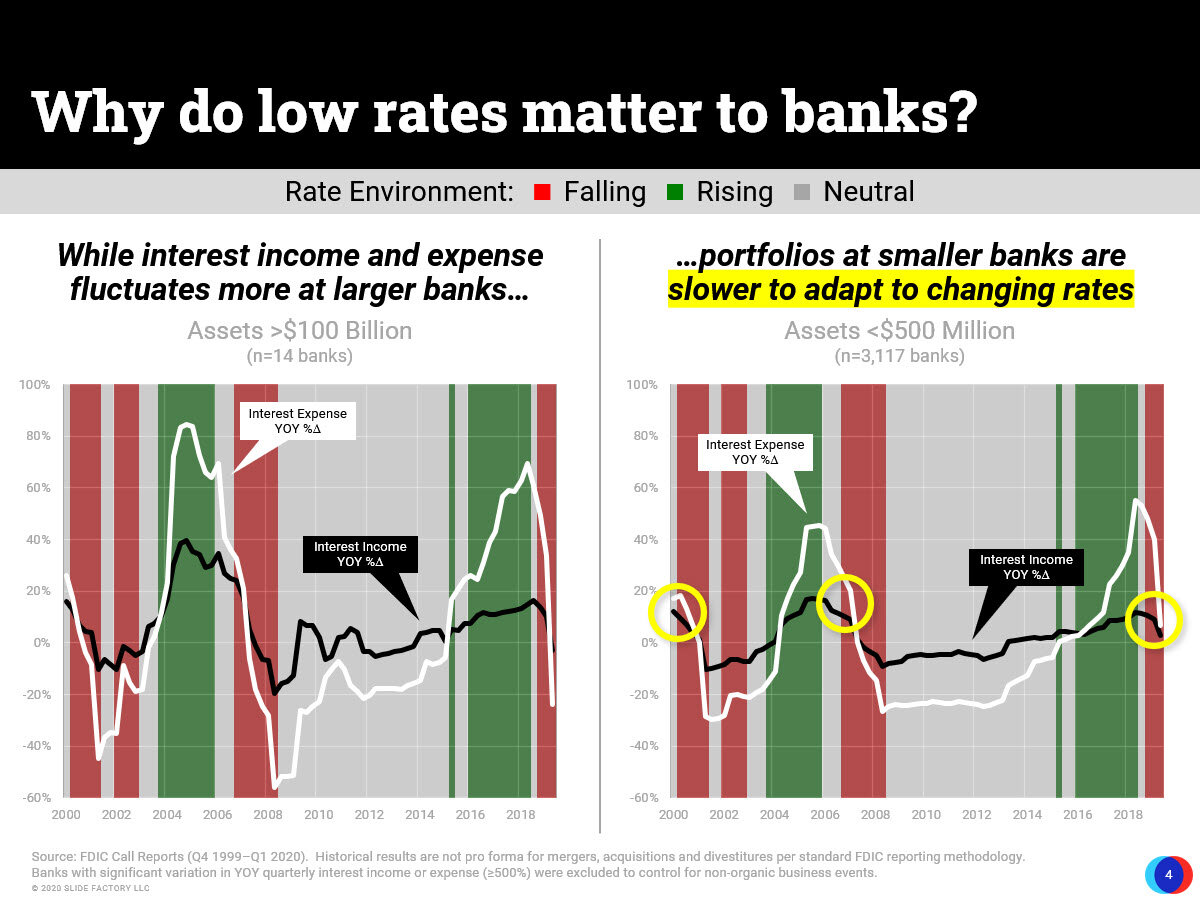

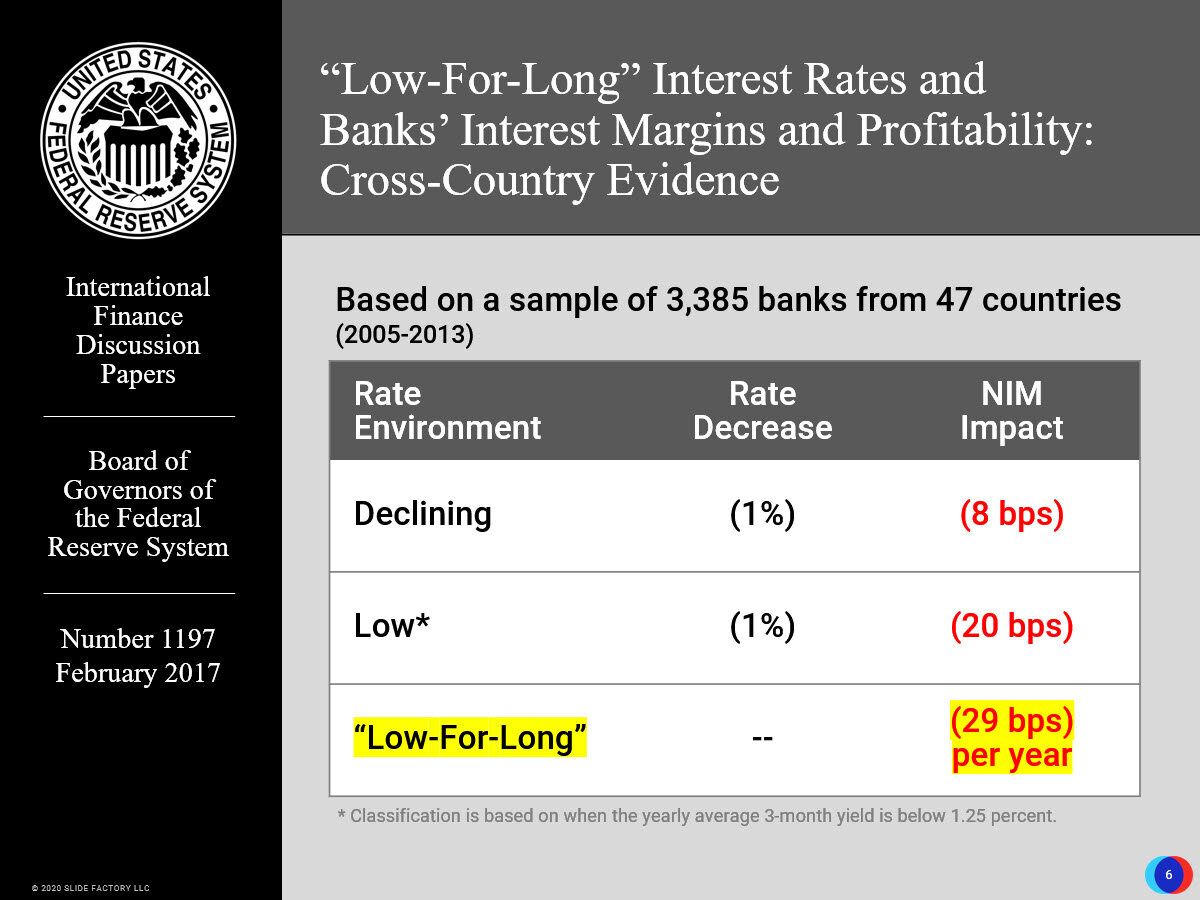

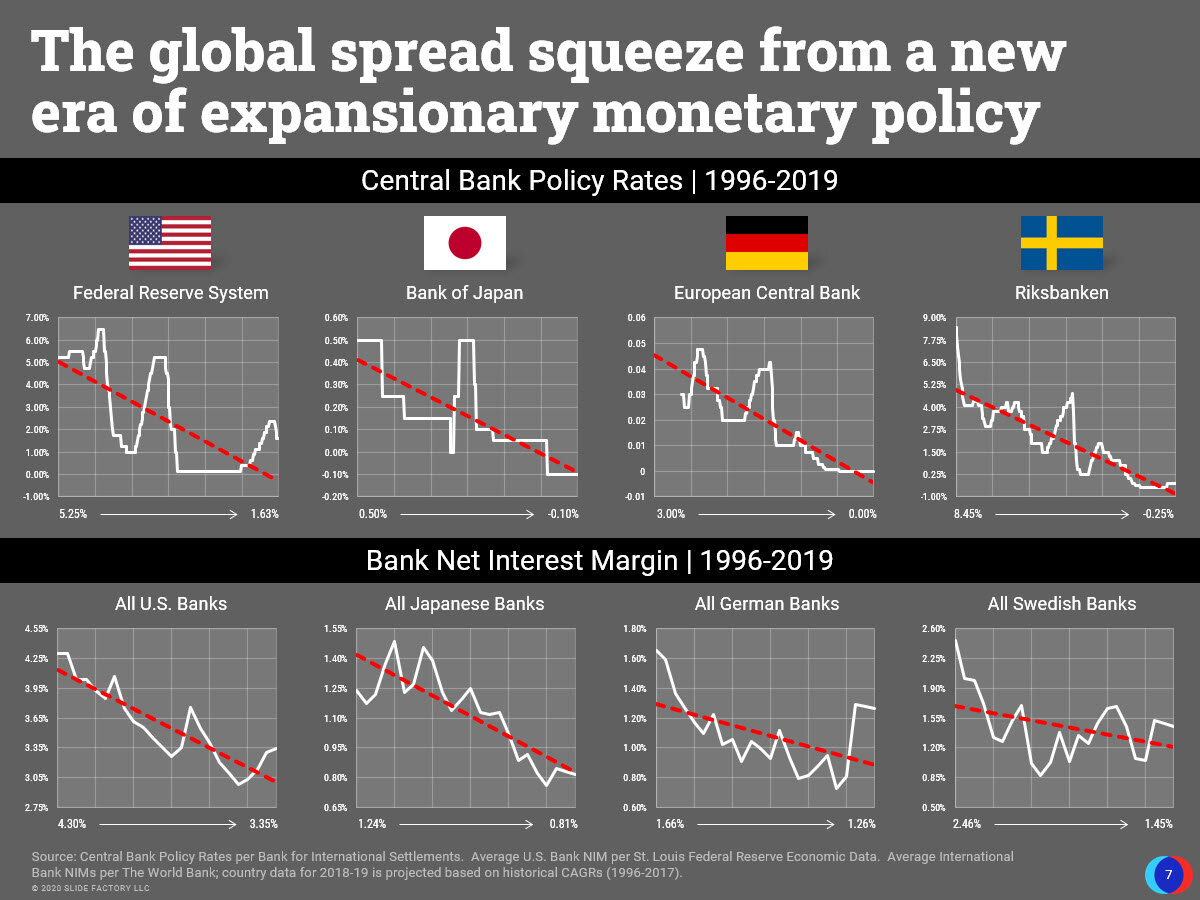

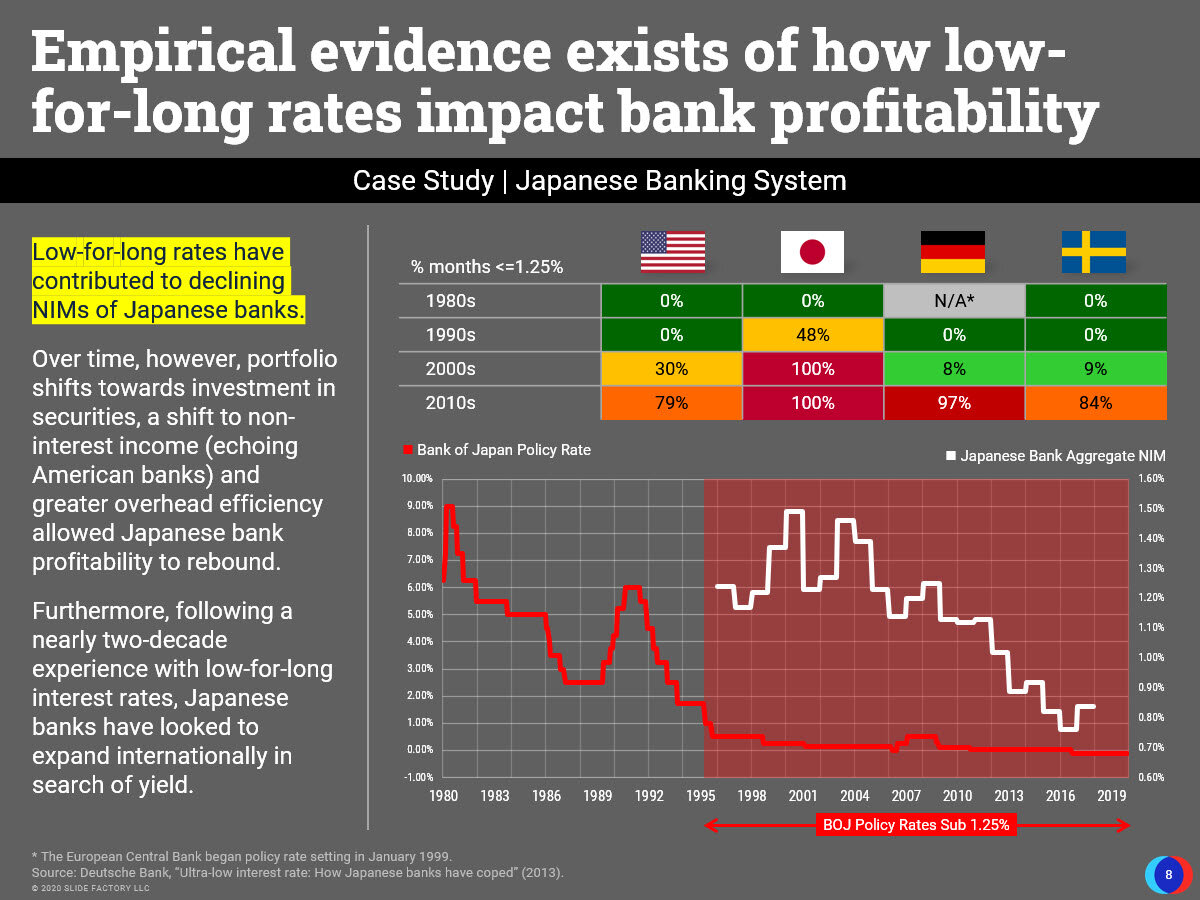

The Low Rate Tsunami

We recently explored the implications of a “low-for-long” interest rate environment and how it impacts bank balance sheets.

Most Efficient Banks

Regardless of asset size or physical branch distribution, an efficiency ratio below 60% remains the gold standard for American banks. While smaller banks like NYCB and EastWest are the most efficient, they also generate a significant portion of their income from spread.

Trading Financial Equities

Banks are valued as a function of profitability and shareholder’s equity. Banks with the highest ROE generally trade at the highest P/B Ratios. Using this as a proxy, banks like 5/3 and BNY are currently undervalued.

Most Efficient Marketers

Huntington and U.S. Bank were the most efficient bank marketers in 2019 with over $75 in revenue generated per $1 of spend.

Banking Gods

Behold the Big Four banks with combined assets of $9 trillion, representing nearly 45% of U.S. GDP. While the Big Four rule the U.S., they pale in comparison to the Big Four in China (ICBC, CCB, AgBank and BOC). These banks are the four largest in the world and represent nearly $15 trillion in combined assets.

Game of Deposits

These are the strategies banks play to win the Game of Deposits. All come with great risk and greater reward. To the victor go the spoils.

The 5G Revolution

The fifth generation of wireless technology is here and will change everything for businesses and consumers.