Blame Bacon

The next time you order your BLT, blame the bacon for the price - it’s risen at a far higher rate than inflation since 1980.

Checks vs. Stripes

Checks over Stripes when it comes to global market share. Stripes over Checks when it comes to YTD stock performance. Take your pick.

Bank Short-Sell Play

Building a case for a bank short-sell play with the latest rate forecast from CME and September’s ISM Manufacturing release. Look to banks that over-index in Net Interest Income exposure or high commercial paper reserves (especially equipment) to take a hit.

The Thirst for Hirst

Here we present average Hirst auction data from 1997-2018 using data visualization in the style of his famous spot paintings.

Household Net Worth

Looking for the best way to gauge the health of the American consumer? Then look no further than the twin barometers of household net worth: 401k and home values. These two indices, along with employment and wage growth, are the strongest indicators of overall economic sentiment.

The State of Housing

Existing Home Sales, New Home Sales and Monthly Housing Starts are among the best metrics to assess the strength of the housing market.

Scaling the Mountain

Banks have an inherent advantage with their all-powerful money storage and payment solutions. However, they will need to develop new capabilities organically or go on the hunt for fintech providers to give their customers a one-stop shop for all of their financial needs.

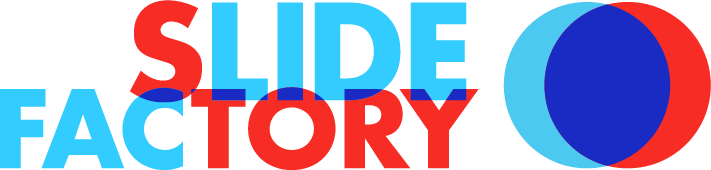

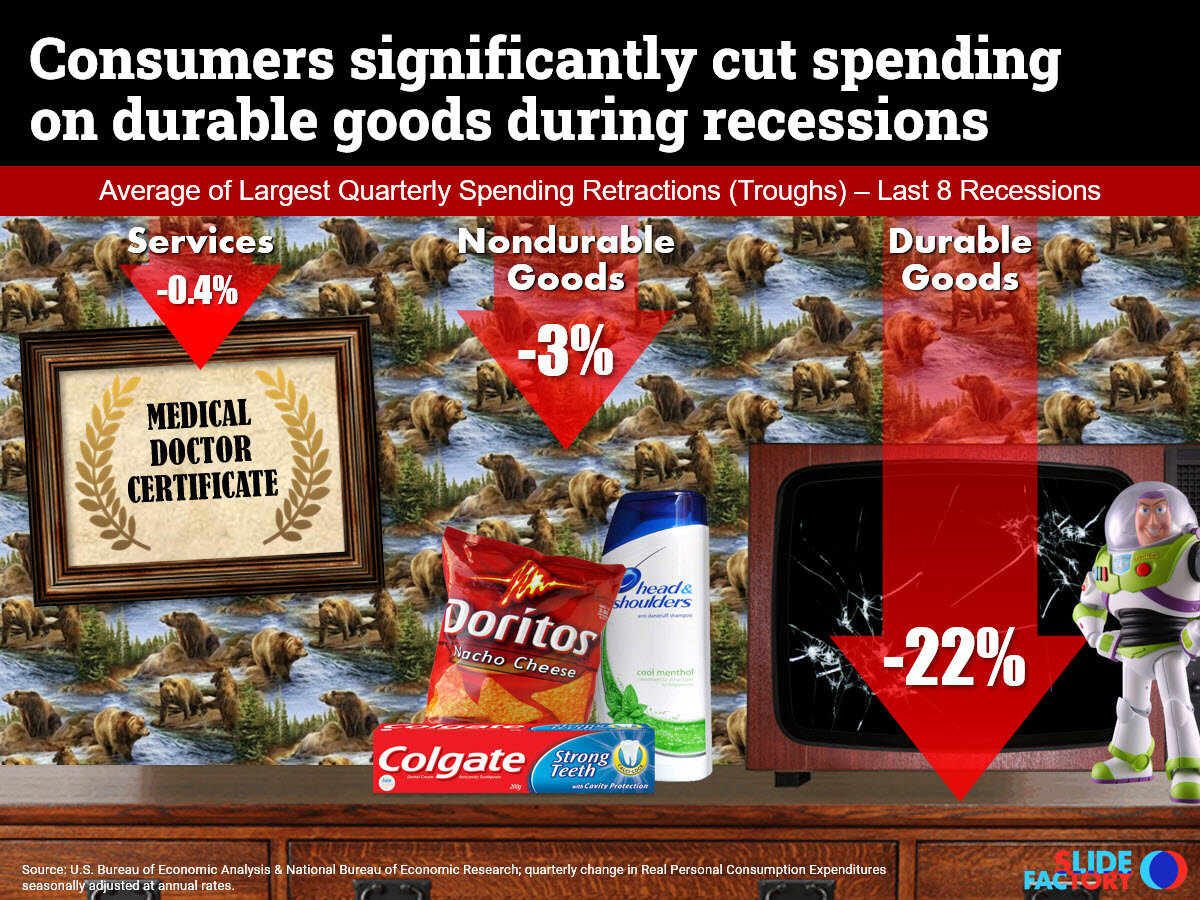

Durable Goods

Spending on durable goods is a leading indicator of macroeconomic health. While spending on services and nondurable goods is less impacted by economic slowdowns, large ticket items like new cars, washing machines or television sets are more likely to be delayed in a recession.

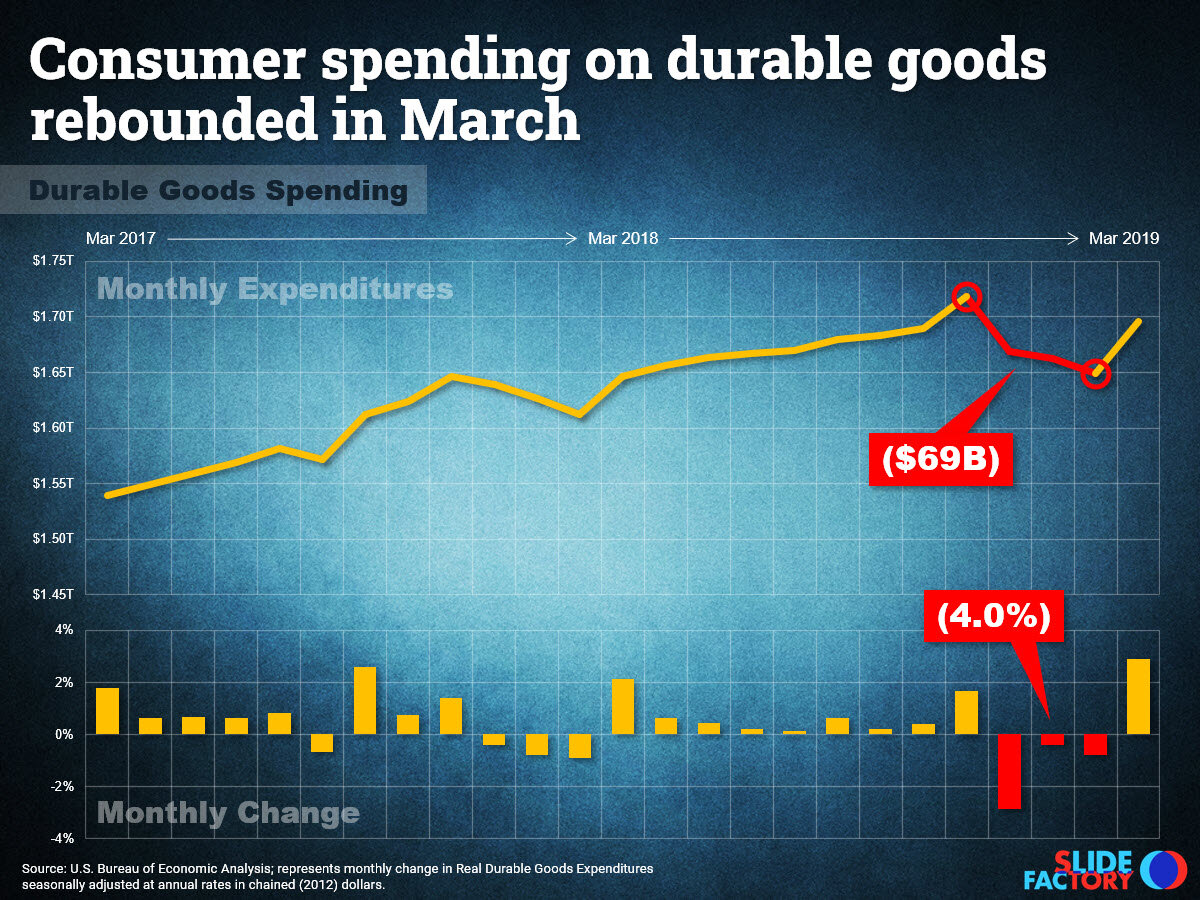

Consumer Spending

Nearly one-quarter of world economic activity occurs in the U.S. and over two-thirds of this output is due to consumer spending.

The World Economy

Looking around the corner at the top drivers of the world economy today.

Hail To The Fed

The Fed governs the growth of our economy with monetary policy, using it keep prices stable, promote maximum employment and maintain moderate, affordable lending rates.

The U.S. Economy

Taking a closer look at the longest period of economic expansion in modern U.S. history.

Predicting the Weather

The Farmer’s Almanac claims to be 80% accurate predicting the upcoming weather season.

Consumer Confidence

Income growth has tapered over the last few months, which may explain the relatively soft consumer sentiment scores despite the unprecedented growth in the economy.

The State of Business

Despite higher levels of business inventories and production capacity, we may be on the verge of the next earnings recession. Waning small business optimism could serve as an early indicator.

Advance Retail Sales

Advance tracking of sales at stores and restaurants dropped a surprising 1.6% in December but rebounded in March.

Retail Apocalypse

Despite the apocalyptic stories in the news, the state of the retail industry is for the most part healthy in 2019. This is important because retail sales account for nearly 18% of total U.S. economic activity.

Recession is Coming?

Wondering if a recession is coming? Consider these three metrics: Yield Curve, Unemployment and Interest Rates.

Mercury Retrograde

Nearly every major stock market crash from Black Monday to the subprime crisis, the worst traffic jams in human history, major weather events, even the sinking of the Titanic…it all happened around or during Mercury Retrograde. Here’s an executive guide for business leaders to navigate through the next bout of Retrograde.